Digital Customer Experience: The Brand Bridge Uniting Culture and Engagement

Published on

December 1, 2022

I am an avid book lover across a wide-range of genres and keep book stores busy. But post-pandemic book sales are experiencing a slight decline, but one particular format of book is selling better than ever — the e-book. In fact, 30% of readers chose an e-book instead of a print book in the last year. While that number may not seem like a majority, it’s a 43% rise within the last decade.[i] Have you read an e-book? If so, why did you choose it over a print book?

For some people, e-books represent a rise in digital convenience. There is no trip to the bookstore. You can borrow it from your local library. You can purchase it 24/7. You can search the “shelves” more easily and (if you’re using Amazon) you can know that some algorithm somewhere is placing curated choices directly in front of you, based on your previous purchases.

Since e-books are digital files, they are also accessible through multiple channels. This includes channels where the purchase is not the primary option. Nearly all public municipal libraries have partnered with digital providers such as Hoopla and Overdrive to allow checkout from the library’s catalog. For college students, the backpack has been getting lighter with digital edition rentals available through common textbook providers and Amazon. Google has also been compiling rights-free titles to keep historical volumes alive for research and fun.

The brand, the brand culture, and customer engagement.

In every case, e-book distribution is heavily tied to the brand — both the publisher and the distribution brand. This is beginning to be the case in insurance as well. Insurance may be sold through a marketplace, sold as a part of another brand’s service package, or even embedded invisibly in another brand’s product or service.

With books, once the distribution has occurred, it’s the responsibility of the publisher to have provided a usable title, with features such as easy search and robust interior links. The customer ‘journey’ through the book is the key driver for retention. With insurance, it’s also the customer journey (along with price) that is the key driver for retention.

Never has the back-end insurance business ever been so connected to the brand. Insurers now wear their culture on their sleeves. Usability is paramount. Insurers show whether or not they care about their customers by the ease of the customer journey. The ideal insurance process draws customers in through multiple, easy-to-use channels, then keeps them happy through “invisible” engagement — processes and tasks that are so easy that even considering a competitive offering would seem like nonsense.

A unified vision that results in an invisible process.

In our last customer experience blog, we considered Six Technology Hurdles to Insurance’s Customer-Friendliness. In today’s blog, we answer those hurdles with one vision — using technology perspectives to plot a course for improved customer engagement. Create a compelling story with customers by turning your internal operations culture into one that you are proud to show off. Connect with customers by connecting platforms, ecosystems, and data. Show them who you are by not showing them the internal constraints you face. Create an “invisible” process where every experience feels natural because it was made to feel that way.

The three lenses of insurance transformation.

Applying the vision from three lenses will allow insurers to see the customer properly and will allow the customer to see insurers accurately and positively.

These lenses include:

The Execution Lens

Implementing the technologies and processes that will make it all possible.

The Ecosystem Lens

Creating an ecosystem of partners that will allow the flow of information and data to automate and improve the process.

The Customer Lens

Delivering a 360-degree experience across numerous activities, unhindered by silos.

When the transparency of the culture and invisibility of the customer experience are aligned, they both tell the story of an organization prepared for the future. Customers can then look into an insurer’s culture and grasp the planning and care, instead of trying to peer in and get a glimpse of the mess.

Non-negotiable technology: the foundations of execution

Process and technology are inextricably linked. Supporting customer features and capabilities requires a specific set of digital technologies to enable the front-end user experience. The technology approach must include strong build-implement-run capabilities and options, including the pre-integration of key solutions. For successful execution, the solution must incorporate component-based design and assembly, plus APIs and pre-integrations.

A next-gen, robust architecture enables redefined business services. Maintenance and upgrades are fine-grained and frequent, far easier to test and place into production.

API libraries make re-use and similar connections simple. Insurers should utilize an extensive API library, such as Majesco API Management and Majesco EcoExchange with partner solutions. Using this, in conjunction with policy, billing and claims, creates a unified platform for integration that can be implemented with key components at any time and in a flexible manner. APIs also give insurers the ability to more easily integrate with multiple vendor systems.

Smart insurance: the framework for ecosystem design

Workflow will drive the next generation of system improvements, and data will make it possible. A digital mindset is important — recognizing that the capture, extraction, and creation of digital data is required to support workflows and analytics across the enterprise. This forms the foundation to improve business intelligence and capitalize on analytics, AI, and advanced technologies.

Straight-through processing is now more possible than ever. The ability to leverage AI in both underwriting and claims is essential for consistent success. Smart data capture involves the intelligent intake of structured data sources, leveraging data pre-fill capabilities and adaptive interviews to ask only the questions required from the customer. In addition, it includes the extraction of unstructured data from PDFs, forms, and other unstructured data sources such as emails. Critical abilities include not only capturing structured data or converting unstructured data into structured data, but also the ability to index data and route it through relevant transaction workflows.

Never-ending journeys: the customer experience that satisfies

Both framework development and technology assessment MUST be utilized through the lens of customer experience. Here is why.

Let’s say, for a moment, that your company is now motivated to improve the customer experience. You spend time in meetings discussing what kinds of features you may like to add to your customer dashboard. You build a case for certain elements to be added to the mix. You consider the balance between what should and should not be shown to a customer without agent guidance. Without using the customer lens, you could end up with services where hurdles and silos are still acceptable and visible.

Is the company identifying the silos, not by what they think they have in the back office, but by what they know they can’t allow customers to do for themselves in the same session?

There’s almost nothing more frustrating than starting over. For the customer, switching systems or apps is like getting sent back to the beginning of a streaming movie or losing a digital bookmark in an e-book. Insurers can begin looking at their customer journeys in light of hurdles, re-keying, re-logins, and do-overs. And, the more insurers utilize security codes and greater password constraints, the more they will need to give full access in one location.

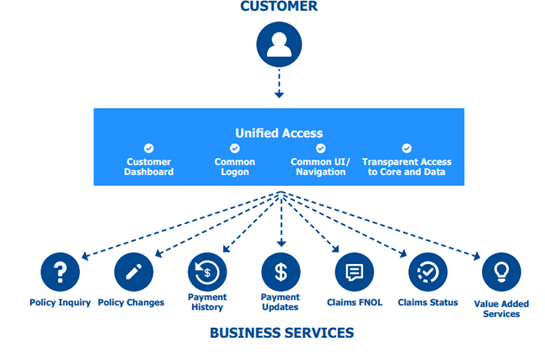

A Customer 360 Vision unifies not only the dashboards but the data sources to provide an experience without hurdles, multiple logins, and start overs. The customer doesn’t want to know that they may be accessing multiple policies, billing, and claims systems for one particular request. They want the complications removed. They want a process that simply works as it should and does not have any hindrances in their way. That is what Majesco Digital Customer360 delivers.

Figure 1: Use Case with a Customer 360 View

Would insurers rather that customers see the inner workings of how silos force them into customer service corners, or would it be better to both cover and fix insurance service issues by creating new systems and processes that hide any trace of hurdles and silos? A Customer 360 Service Vision makes its own case for new approaches to systems and data.

Staying “on brand”

There’s a commonly used term in business today — “on brand.” The idea is interesting. It forces companies to assess whether or not their products, services, and culture fit their brand, or if maybe the organization itself needs to shift to allow an internal “re-branding” that will fit the customer. Does your back-office brand fit the brand culture that you wish to portray? Are you able to engage the new generation of insurance customers? Is your organization growing uncomfortable with being able to stay on brand as an insurer with competitive offerings in the industry?

Now is the time to assess and shift. Grow the brand that will meet today’s and tomorrow’s needs by creating a brand-ready, brand-capable, brand-new digital customer experience. Be sure to read Core Modernization in the Digital Era, or watch Insurance Growth & Opportunities — How Next Gen Technology, Products, Data, Channels and Ecosystems are Driving Change in the Face of Increasing Market Changes.

[i] Faverio, Michelle and Andrew Perrin, Three-in-ten Americans now read e-books, Pew Research Center, January 6, 2022.