Hospital finances in 2022: Outlook is grim

Based on some recent reports, hospital finances in 2022 look poor. Government cash infusions from COVID-19 were helpful during the pandemic but have largely disappeared. At the same time, costs for labor and supplies have risen. Adding on to these financial pressures is the recent rise in the number of RSV cases.

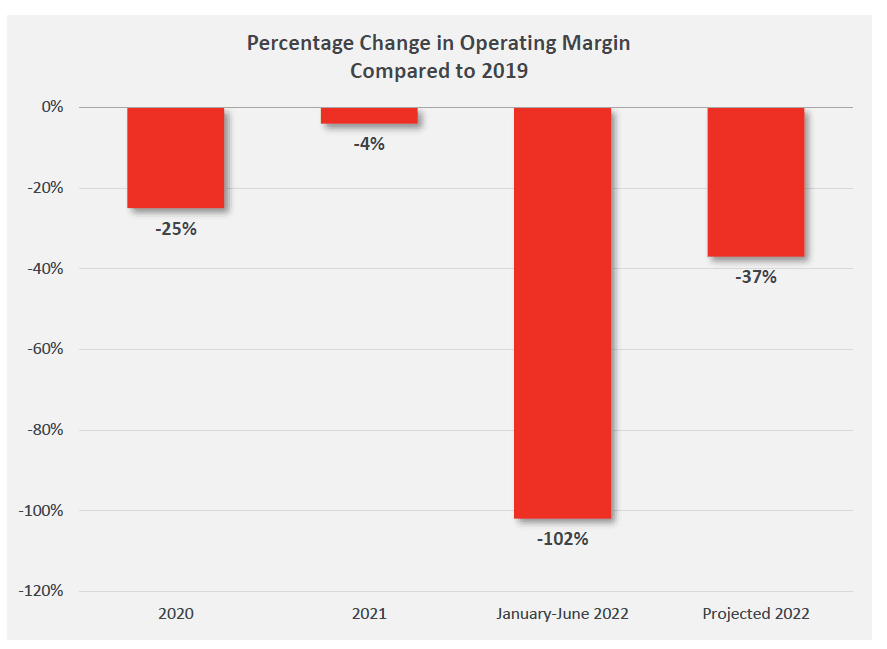

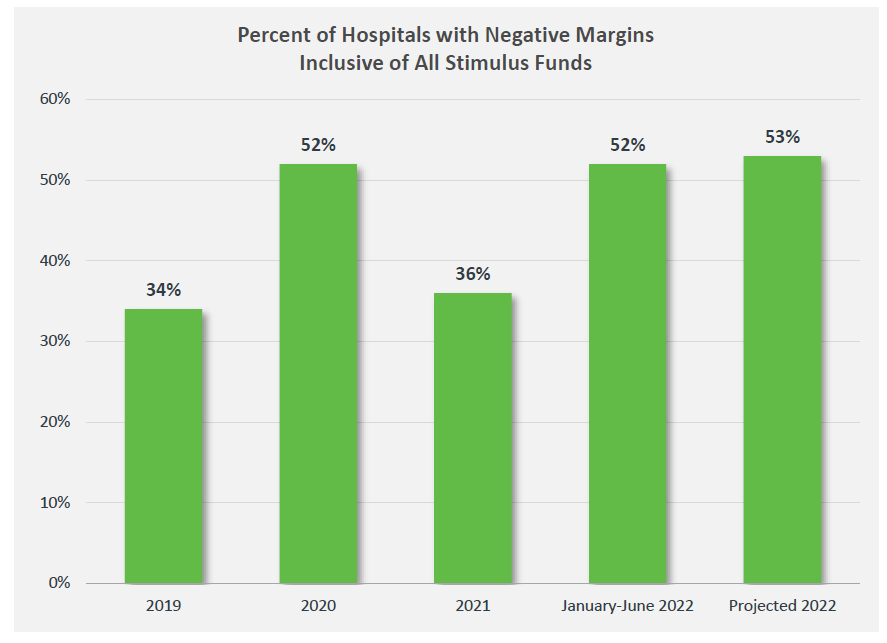

According to a report from the American Hospital Association, hospital margins are down 37% from pre-pandemic (2019) levels. Moreover, more than half hospitals are projected to have negative margins.

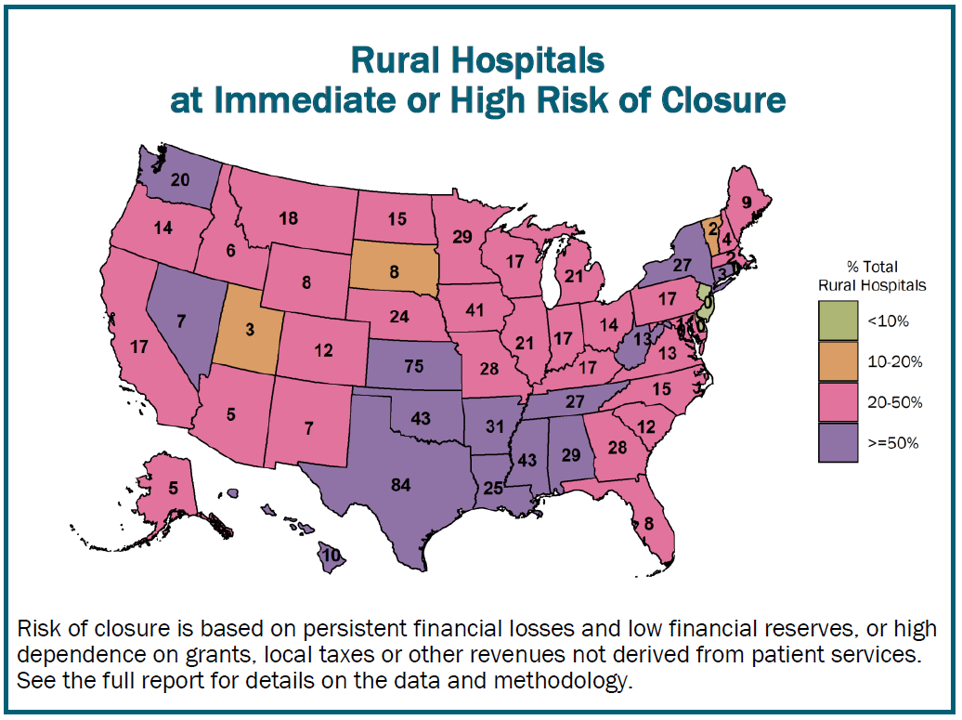

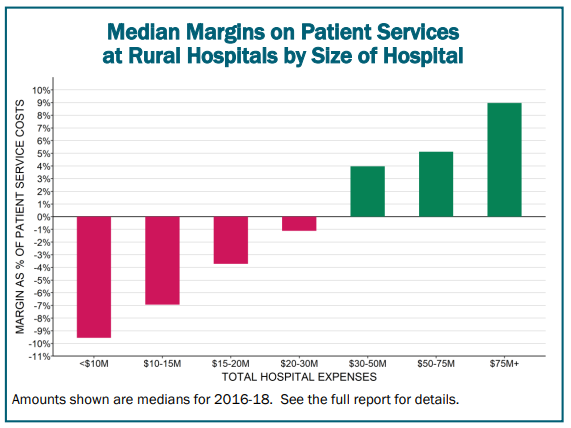

Rural hospitals are also in a bind. A report from the Center for Healthcare Quality & Payment Reform (Miller 2020) found that many rural hospitals are in financials straights. More than 800 rural hospitals – 40% of all rural hospitals in the country – are at risk of closing in the near future. Part of the reason is that rural hospitals are often smaller in size due to reduced population density in rural areas. The report notes:

The average cost of an emergency room visit, inpatient day, laboratory test, imaging study, and primary care visit is inherently higher in small rural hospitals and clinics than at larger hospitals because there is a minimum level of staffing and equipment required to deliver each of these services regardless of how many patients need to use them. For example, a hospital Emergency Department has to have at least one physician available around the clock in order to respond to injuries and medical emergencies quickly and effectively, regardless of how many patients actually visit the ED. A smaller community will have fewer ED visits, but the standby capacity cost of the ED will be the same, so the average cost per visit will be higher.

Unsurprisingly, hospital margins are generally lowest at the smallest hospitals.

How are hospitals likely to respond to these financial constraints? Based on a paper from Robinson et al. (2011), the answer likely depends on the specific market structure under which the hospital falls.

…faced with shortfalls between Medicare payments and projected costs, hospitals in concentrated markets focus on raising prices to private insurers, while hospitals in competitive markets focus on cutting costs…

Policymakers may need to walk a tightrope around cost control and cost shifting to private payers.

Public policy seeks both to restrain Medicare spending and encourage provider coordination. Whether these two strategies lead to a lowering of overall cost trends or an accelerating shift in costs from public to private insurers is the question that remains open.