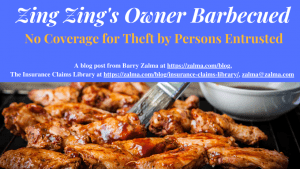

Zing Zing’s Owner Barbecued

See the full video at https://rumble.com/v1x3e74-zing-zings-owner-barbecued.html and at https://youtu.be/KQY7P3q0bCk

When the plaintiff turned her restaurant over to two restaurateurs when she became ill they took out all of the equipment of the restaurant and converted it to their possession. The restaurateurs claimed they purchased the equipment from plaintiff and she claimed they took advantage of her illness and stole the property. She made a claim to her insurer, State Farm, who denied the claim because either cause alleged was due to a peril not insured or a peril specifically excluded.

In Tomazina Johnson, d/b/a Zing Zing’s Wings & More, LLC v. State Farm Fire & Casualty Company, No. 2:20-cv-02912-cgc, United States District Court, W.D. Tennessee, Western Division (November 23, 2022) the USDC resolved the dispute by reading the full policy and applying its language to the facts established by State Farm’s motion.

INTRODUCTION

Plaintiff’s Circuit Court Complaint alleged two claims: breach of contract and bad-faith refusal to pay an insurance claim pursuant to Tennessee Code Section 56-7-105.

State Farm moved for Summary Judgment arguing that Plaintiff’s claim for breach of contract failed as a matter of law because the Policy does not provide coverage regardless of which version of the evidence a trier of fact would choose to accredit. Specifically, the Policy does not provide coverage either if the property was sold to third parties or if the property was entrusted to third parties and removed or stolen by them.

Plaintiff argued that the Policy provides coverage for accidental physical loss of business personal property and that she has met her initial burden of establishing that an accidental, direct loss during the Policy period.

THE INSURANCE POLICY

State Farm issued a businessowner’s insurance policy that was in full force and effect insuring Plaintiff’s restaurant business, Zing Zing’s Wings & More, LLC (“Zing Zing’s”). The Policy provides that State Farm insures for the “accidental direct physical loss to Covered Property.” However, “Section I – EXCLUSIONS” and the “Property Subject to Limitations” provisions limited the coverages available to the Plaintiff. The policy contained the following exclusion:

Dishonesty

(1) Dishonest or criminal acts by you, anyone else with an interest in the property, or any of your or their partners, “members,” officers, “managers,” employees, directors, trustees, or authorized representatives, whether acting alone or in collusion with each other or with any other party; or

(2) Theft by any person to whom you entrust the property for any purpose, whether acting alone or in collusion with any other party.

This exclusion applies whether or not an act occurs during your normal hours of operation.

This exclusion does not apply to acts of destruction by your employees; but theft by your employees is not covered.

With respect to accounts receivable and “valuable papers and records,” this exclusion does not apply to carriers for hire.

The exclusion set forth in subsection 2(g) of the Policy (“False Pretenses Exclusion”) states as follows:

False Pretense

“Voluntary parting with any property by you or anyone else to whom you have entrusted the property if induced to do so by any fraudulent scheme, trick, device or false pretense.”

Evidence of Events Relevant to Plaintiff’s Claims

Plaintiff opened her restaurant Zing Zing’s. Its grand opening took place in February of 2019. However, while Plaintiff was operating the restaurant, it was operating at a loss.

On the advice of counsel Plaintiff dealt with two individuals-Curtis Braden (“Braden”) and Rayford Burns (“Burns”)- who were to take over Zing Zing’s while she was ill.

While the Policy remained in effect, Plaintiff testified that she “entrusted” her “business property and business” to Braden and Burns, provided them keys to the business, allowed them to temporarily operate her restaurant, allowed them to use her property and equipment, allowed them to sell food that she had already purchased, and allowed them to use the services of her employees for at least some period of time. Plaintiff testified that, while Braden and Burns were doing so, she would continue to pay her employees’ wages, the utilities, and all other bills related to the business, but Braden and Burns would pay the rent and keep the profits. During this arrangement, Plaintiff did not characterize Braden and Burns as her employees.

Plaintiff testified that, after entrusting Zing Zing’s to Braden and Burns, she was contacted by the landlord of Zing Zing’s who told her that the business was shut down. After receiving this phone call, Plaintiff went to Zing Zing’s and encountered two neighbors of the business who told her that the individuals she had allowed to operate the restaurant had removed everything out of the restaurant through the back door. Plaintiff reported to State Farm that Braden and Burns stole all of her property from Zing Zing’s.

Braden’s version of events is substantially different. He testified that Plaintiff transferred Zing Zing’s and its equipment and property to Burns by way of Bill of Sale. Braden testified that he observed Plaintiff initial and sign the Bill of Sale and that he notarized it. Plaintiff continued to testify that she has “no idea” why her initials and signature were on the Bill of Sale and contends that it is a fraudulent document.

Ultimately, State Farm denied Plaintiff’s claim under the Policy.

Plaintiff provided an itemized list of property related to her claim that totals $20,052.48.

ANALYSIS & CONCLUSIONS OF LAW

Breach of Contract Claim

Plaintiff’s first claim alleges breach of contract by State Farm. There is no dispute that State Farm issued the Policy and that it was in effect at all times relevant to Plaintiff’s claim. Thus, the legal question at issue here is whether State Farm failed to perform its obligations under the Policy by denying Plaintiff’s claim for coverage.

The evidence before the Court failed to show that any dispute exists as to who removed the property. Plaintiff informed State Farm that Braden and Burns stole the property, and she personally continues to believe that Braden and Burns are responsible. She entrusted the property to Braden and Burns if they stole the property as alleged the theft was excluded.

Statutory Bad Faith Claim

Plaintiff’s second claim alleges a statutory claim for bad faith refusal to pay pursuant to Tennessee Code Annotated Section 56-7-105. To prevail on such a claim, the following elements must be met:

the policy of insurance must, by its terms, have become due and payable;

a formal demand for payment must have been made;

the insured must have waited sixty days after making his demand before filing suit (unless there was a refusal to pay prior to the expiration of the 60 days); and,

the refusal to pay must not have been in good faith.

The Court determined that the Policy did not provide coverage for Plaintiff’s claim as a matter of law since both possible causes of loss were excluded. Since Plaintiff’s claim has never been “due and payable” Plaintiff’s statutory claim for bad faith refusal to pay fails as a matter of law.

A sad tale of a person who – because she was ill – entrusted her property to two individuals who claimed they purchased the property and who she claimed stole the property. Unfortunately for the plaintiff either occurrence was specifically, clearly and unambiguously excluded.

(c) 2022 Barry Zalma & ClaimSchool, Inc.

(c) 2022 Barry Zalma & ClaimSchool, Inc.

Subscribe and receive videos limited to subscribers of Excellence in Claims Handling at locals.com https://zalmaoninsurance.locals.com/subscribe.

Go to substack at substack.com/refer/barryzalma Consider subscribing to my publications at substack at substack.com/refer/barryzalma

Barry Zalma, Esq., CFE, now limits his practice to service as an insurance consultant specializing in insurance coverage, insurance claims handling, insurance bad faith and insurance fraud almost equally for insurers and policyholders. He practiced law in California for more than 44 years as an insurance coverage and claims handling lawyer and more than 54 years in the insurance business. He is available at http://www.zalma.com and zalma@zalma.com

Write to Mr. Zalma at zalma@zalma.com; http://www.zalma.com; http://zalma.com/blog; daily articles are published at https://zalma.substack.com. Go to the podcast Zalma On Insurance at https://anchor.fm/barry-zalma; Follow Mr. Zalma on Twitter at https://twitter.com/bzalma; Go to Barry Zalma videos at Rumble.com at https://rumble.com/c/c-262921; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the Insurance Claims Library – https://zalma.com/blog/insurance-claims-library

Like this:

Loading…

Related