Four types of insurance you will need and why

In this article, Insurance Business lists down the different insurance types everyone should consider purchasing to ensure they are financially protected. This is part of our client education series, and we encourage insurance agents and brokers to share this article with customers to help them sort through the different coverages available.

Here are the main insurance types that many industry experts say are worth taking out and how each coverage type works in different parts of the world.

In most regions, motorists are required to carry at least a certain level of coverage to legally operate a vehicle. Getting caught driving without one can result in hefty penalties and may impact future eligibility for obtaining coverage.

United States

In the US, nearly every state mandates that drivers have to have the following coverages, according to the Insurance Information Institute (Triple-I):

Bodily injury liability: Covers medical and legal costs associated with injuries or death for which the driver is at-fault.

Property damage liability: Pays out if the policyholder’s vehicle damages another person’s property, as well as legal costs incurred in a lawsuit.

Medical payments (Med Pay) or personal injury protection (PIP): Covers medical expenses for injuries the policyholder and their passengers sustain in an accident. Some policies also pay out for lost income.

Uninsured/underinsured motorist coverage (UM/UIM): Pays out for injuries the policyholder and their passengers suffer if they are hit by an uninsured or underinsured driver.

Canada

Canadian provinces and territories have their own rules and regulations when it comes to mandatory coverage. Because each implement different car insurance systems, there are also varying requirements. But there are also similarities. These are:

Third-party liability: Covers the cost of lawsuits if the policyholder is responsible for an accident that causes bodily injury, death, or property damage.

Uninsured automobile/motorist: Provides coverage if the policyholder or their passenger is injured or killed by an uninsured driver or in a hit-and-run incident. But unlike in the US, this also covers damages to the policyholder’s vehicle.

Accident benefits: Pays out for medical treatments and income replacement if the policyholder is injured in an accident and funeral expenses should they succumb to their injuries, regardless of who is at-fault. This works similar to Med Pay or PIP in the US.

United Kingdom

In the UK, the government requires drivers to take out third-party insurance. This covers damage or injury caused by the policyholder to another person, vehicle, animal, or property. Just like liability coverage in other countries, it does not cover damages to the policyholder’s vehicle.

Australia

Australia mandates that drivers carry at least one type of coverage – compulsory third-party (CTP) insurance. Also known as green slip insurance in New South Wales or transport accident charge (TAC) in Victoria, CTP insurance covers the driver’s liability if other people are injured or killed in a vehicular accident. This type of policy, however, does not cover injuries to the driver and their passengers, and damages to any vehicle or property. This type of coverage is paid for when car owners renew their vehicle registration.

Health insurance policies are aimed at helping policyholders offset the costs of medical treatment by covering a part of the professional and hospital fees the policyholder incurs. Because each country implements a different public healthcare system, the level of need for private health plans also varies.

United States

Due to the high cost of healthcare in the US, taking out health insurance is necessary for many Americans to be able to afford the necessary medical care. According to the government’s health insurance exchange website HealthCare.gov, health coverage comes in several forms aimed at meeting the varying needs of policyholders.

Among the kinds of policies currently available in the market are:

Exclusive Provider Organization (EPO): A managed care plan where services are covered only if the doctors, specialists, or hospitals are in the plan’s network, except in emergency cases.

Health Maintenance Organization (HMO): Limits coverage to care from doctors who work for or are contracted with the HMO.

Point of Service (POS): Policyholders pay less if they access doctors, hospitals, and other healthcare providers belonging to the plan’s network.

Preferred Provider Organization (PPO): Lets policyholders pay less for healthcare if they choose to get treatment from providers in the plan’s network, although they can also access doctors, hospitals, and providers outside of the network without a referral for an additional cost.

US health insurance plans are required to cover a list of 10 “essential health benefits.” This is the result of the standardization of insurance plan benefits under the Affordable Healthcare (ACA).

Birth control and breastfeeding coverage are also required benefits. Dental and eye care coverages for adults and medical management programs, however, are not considered essential benefits, but are available as optional extras.

Canada

Canada’s healthcare system is regarded as one of the best in the world, providing all citizens and permanent residents free access to emergency care and regular doctor visits. However, there are still certain services that Medicare – the country’s universal health coverage – does not cover. These include eye and dental care, outpatient prescription drugs, rehabilitation services, and private hospital rooms, which Canadians need to pay for, either out of pocket or through supplemental private insurance.

The country’s public healthcare system covers many of the “basics.” These include:

Doctor and hospital visits

Diagnostics and examinations

Eye examinations for Canadians aged under 18 or over 65

Medically necessary dental surgeries

Standard accommodations in the hospital, including care, food, and prescriptions

Surgeries and treatments

Each province and territory implement their own rules when it comes to health coverage, so the exclusions may vary. For the following items and services, private health insurance may be necessary to obtain cover, depending on where a person resides.

Ambulance and EMT services

Dental care

Massage therapy

Medical equipment, including wheelchairs, crutches, and leg braces

Outpatient prescription medications

Physiotherapy

Prescription eyeglasses

Private hospital room stays

Psychological services

United Kingdom

UK citizens and permanent residents are entitled to free healthcare through the National Health Service (NHS). Coverage typically includes:

Consultations with general practitioner (GP) or nurse

Hospital treatment in accidents and emergencies (A&E)

Treatment of minor injuries in clinics

Treatment with a specialist or consultant if referred by a GP

Contraception and sexual health services

Maternity services

People also have the option to take out private health insurance, which allows them to access specialists more quickly, avoid long waiting times, and use better facilities.

Australia

Despite having access to one of the best public healthcare systems in the world, Australians may still need to endure long waiting times for non-life-threatening procedures. They may also need to pay for certain services that Medicare – the country’s universal health insurance – does not cover. These include ambulance, dental, optical, and chiropractic care.

This is the reason why the government is encouraging citizens to take out private health insurance through tax incentives and premium rebates.

Private health insurance in Australia is designed to pay out for medical expenses that are not covered under the public healthcare system and Medicare. It can also cover the cost of treatment in a private hospital or if one chooses to be treated as a private patient in a public hospital. Policies must be bought from registered health insurers.

Private health coverage comes in two main types:

Hospital cover: Pays out the cost of treatment in a public or private hospital.

Extras cover: Also called general treatment cover, pays out the costs of medical services that Medicare does not cover.

Ambulance cover, which includes emergency transport and medical care, can also be purchased in most states and territories, except in Queensland and Tasmania as these states already provide automatic coverage for permanent residents.

Life insurance works almost exactly the same in different regions, although policy names may vary. This type of coverage provides a tax-free lump-sum payment to the policyholder’s family after they die. Coverage comes in different forms, but generally falls into two categories:

Term life insurance

This type of policy covers the insured for a set term, paying out the death benefit if the policyholder dies within a specified period. This means payments can also be accessed in the years that the plan is active. Once the term expires, the insured can either renew or terminate the plan.

Permanent life insurance

Unlike term life insurance, a permanent policy does not expire. It is also referred to as whole of life policy in the UK. In the US and Canada, coverage comes in two main types, each combining the death benefit with a savings component.

Whole life insurance: Offers coverage for the entire lifetime of the insured and the savings can grow at a guaranteed rate.

Universal life insurance: Uses different premium structures, with earnings based on how the market performs.

A life insurance policy covers almost all types of death, including those due to natural and accidental causes, suicide, and homicide. Most policies, however, include a suicide clause, which voids the coverage if the policyholder commits suicide within a specific period, usually two years after the start of the policy date.

Some life insurance providers may also deny a claim if the policyholder dies while engaging in a high-risk activity such as skydiving, paragliding, off-roading, and scuba diving. Additionally, an insurer may reject a claim based on the circumstances surrounding the death. For instance, if the beneficiary is responsible for or involved in the policyholder’s death.

Life insurance policyholders are required to designate a beneficiary. This can be the insured’s spouse, immediate family, other relatives, friends, business partners, or even a charitable organization. Policyholders are also allowed to name several beneficiaries for their life insurance plans and assign how much benefit each person or group will receive.

There are two types of beneficiaries:

Revocable beneficiary: They can be replaced anytime without the need for the policyholder to inform them.

Irrevocable beneficiary: They cannot be replaced unless the policyholder secures a written permission signed by them.

Home insurance, also referred to as homeowners’ insurance in the US and Australia, is not legally required in many countries, although lenders set it as a condition for taking out a mortgage. Despite not being compulsory, many industry experts still recommend property owners to take out coverage given the huge financial investment most people make when buying a home.

United States

According to Triple-I, a standard homeowners’ insurance policy in the US provides four essential types of protection:

Coverage for the structure of the home: Pays out for any physical damage or loss to the house and other structures within the property’s premises – including sheds, garages, and fences – if this was caused by a covered peril.

Coverage for personal belongings: Covers personal possessions such as clothing, electronics, furniture, jewelry, and other household items that were damaged or lost due to specified perils.

Liability protection: Pays out for lawsuits and other legal expenses stemming from injuries to guests while on the property or its premises.

Additional living expenses: Covers the additional costs of living away from home – including hotel bills, restaurant meals and other living expenses – if a house is inhabitable due to damage from an insured disaster.

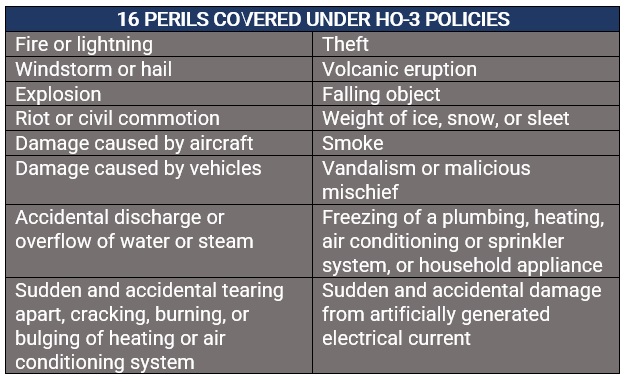

HO-3 policies are the most popular type of home insurance as it provides the widest coverage. These policies protect against these 16 perils:

Other insurance types available for US homeowners are:

HO-1: The most basic and limited type of policy suited for single-family homes, although this type of coverage is extremely rare nowadays

HO-2: A slight upgrade from HO-1 policies

HO-4: Coverage designed specifically for renters, usually called renters’ insurance

HO-5: The most comprehensive form of homeowners’ coverage

HO-6: Coverage designed specifically for condo owners

HO-7: Coverage designed for a mobile or manufactured home

HO-8: A special type of homeowners’ policy for older homes that do not meet insurer standards

Canada

Canadian property owners have three types of home insurance policies to choose from, each providing different levels of protection.

Standard coverage: The most basic form of protection, this covers only the risks or perils named in the policy. Coverage typically includes fire, lightning, smoke, and theft.

Broad coverage: Provides a wider range of protection than standard policies, but does not offer full coverage, unlike comprehensive home insurance.

Comprehensive coverage: Also called special or all-perils policy, this offers the most extensive form of coverage. It protects the property and its contents against most types of risks, except for those specifically named as exclusions from the plan.

United Kingdom & Australia

Homeowners in the UK and Australia can access two main types of coverage for their properties:

Buildings coverage

Buildings insurance covers the cost to repair, rebuild, or replace the structure of the home, along with its fixed fittings, if it is damaged by a man-made or natural disaster. This includes fire, smoke, storm, flooding, falling objects, subsidence, or vandalism.

This kind of coverage typically insures the home’s physical structure – including the walls, ceiling, and roof – and permanent fixtures – including fitted kitchens, internal doors, integrated appliances, and bathroom suites. Some policies also cover external structures not attached to the house such as garages, sheds, and fences.

Contents insurance

Contents coverage, meanwhile, pays out the cost of replacing personal belongings inside the home if they are stolen or damaged. In the UK, coverage comes in two main types:

Indemnity policies: Pay out for the value of an item factoring in depreciation.

New-for-old plans: Cover the cost of replacing an item with a brand-new version.

Contents insurance mostly covers the following items:

Furniture – beds, dining chairs and tables, sofa sets, wardrobes

Home accents – carpets, curtains, cushions, bedding

Appliances – fridges and freezers, stoves and ovens, washing machines

Kitchenware – cookware, cutlery, dinnerware

Gadgets – laptops, mobile devices, TVs

Clothing and fashion accessories

Toys, antiques, ornaments

Garden equipment – tools, lawnmowers, garden furniture

One of the biggest benefits of getting the right insurance type is the peace of mind of knowing that if accidents and disasters strike, you have the financial means to rebuild your life. Having proper coverage also means that the road to recovery from unexpected events is often faster and smoother sailing.

What about you? What other insurance types do you feel are essential to protect your assets? Share your thoughts in our comment section below.