Auto experts share takeaways on Q3 woes at Rivian, Lucid, Canoo

Rivian manufacturing

Rivian

The electric-vehicle startups Rivian, Lucid, and Canoo released third-quarter results this week.

Startups are still scrambling to get cars to customers as production increases.

Industry experts remain optimistic after the results.

Rivian, Lucid, and Canoo all reported third-quarter earnings this week, and the results make clear that the electric-vehicle startups are still scrambling to fulfill large delivery backlogs, even as production ramps up.

At the same time, the would-be “next Teslas” are still grappling with the challenges of ramping up manufacturing as their stock prices decline.

Rivian and Lucid each made progress toward their production goals for the year and steadily increased customer deliveries. But both saw the gap between production and deliveries widen in the quarter. Canoo has yet to make any production vehicles.

“The reality is, we’ve seen the continuation of how challenging this can be,” Pavel Molchanov, a Raymond James analyst, told Insider.

We gathered insights from Molchanov and three other auto experts about the third-quarter earnings and what they anticipated from these firms for the final months of what has been a difficult 2022. Here are their key takeaways.

Rivian reports more progress

Rivian produced 7,363 vehicles and delivered 6,584 in the third quarter, with a total of 14,317 built and 12,278 delivered since the start of the year.

After it closed the gap in the second quarter, Rivian’s pace of deliveries again fell behind production by 779 vehicles. Claire McDonough, its chief financial officer, attributed this backlog to setbacks related to ramping up a second shift at the company’s Normal, Illinois factory and aligning a new production schedule with changes to delivery logistics and a slower holiday period. She expects the gap to close again early next year.

“What we don’t deliver in Q4 rolls into the upcoming quarter, so you start to normalize over time as we ramp closer to the installed capacity,” McDonough told investors on the Q3 call.

CEO RJ Scaringe told investors the addition of a second production shift in Normal should push Rivian toward its 25,000-vehicle goal by year’s end, but warned of challenges as the company ramps up production.

“While the ramp curve is much faster than what we went through on the first shift,” Scaringe said, “it’s not as if it starts immediately at 100% output.”

Experts saw Wednesday’s results as a sign that Rivian continues to make progress toward meeting its target of 25,000 vehicles this year.

“We are cautiously optimistic that many of the headaches in the Rivian story are starting to be in the rear view mirror,” Wedbush analyst Dan Ives said in a note following earnings.

One damper for experts was Rivian’s pushing the smaller, more inexpensive R2 platform launch from 2025 to 2026.

“The company’s more material volume improvement will now not come until after 2025,” Deutsche Bank analyst Emmanuel Rosner wrote in a recent note. “While this may come as unwelcomed news, we believe the company is making the change to ensure appropriate time to go through the ramp-up phase.”

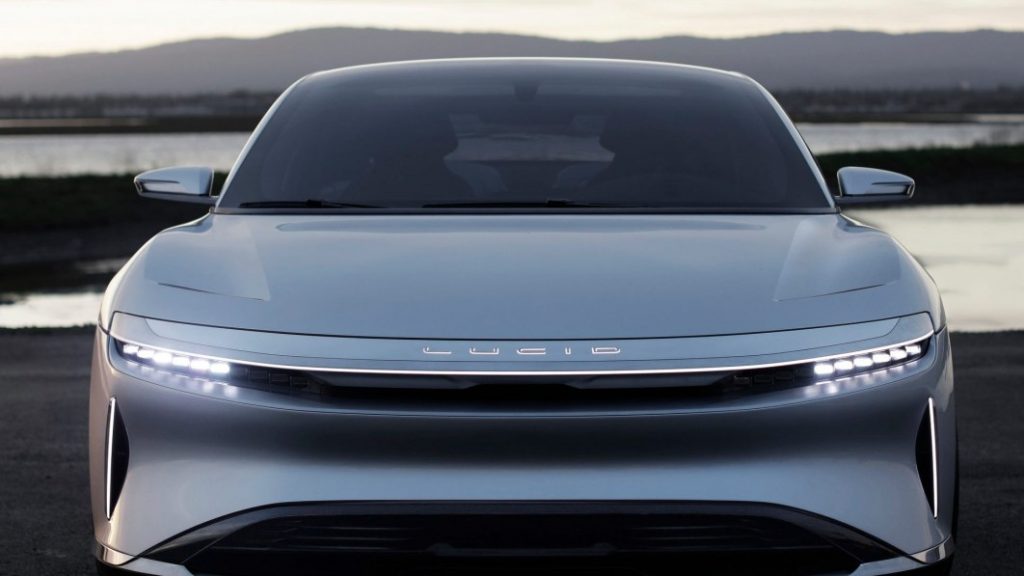

Lucid’s racing to the end of the year

Lucid reported it produced 2,282 cars in the quarter and delivered 1,398 to customers, with revenue of $195.5 million. In the first three quarters, it built 3,687 vehicles and delivered 2,437.

This quarter signaled Lucid is getting closer to its current target of between 6,000 and 7,000 vehicles, about a third of what it planned to make going into 2022. Lucid had 34,000 reservations at the close of Q3, down from 37,000 in Q2.

It also had $3.85 billion in cash on hand (down from $4.6 billion the previous quarter), and saw a net loss of $670.2 million. Though Lucid said it had enough cash to last another year, it announced plans to raise $1.5 billion.

Lucid underwent some changes in Q3 following a rough second-quarter. Several operations-related leaders left the company.

“We brought our logistics operations in-house,” CEO Peter Rawlinson said in a Q3 call. “We brought in exceptional leadership. We’ve addressed some of the gating factors impacting Q2 production.”

Ali Faghri, managing director of automotive research at Guggenheim Securities, told Insider that the progress is promising, but investors still have questions about Lucid’s ability to scale.

“The fact that reservations are already declining before Lucid has even gotten to higher levels of deliveries will probably lead to more concerns from investors,” Faghri said.

Canoo’s got another new plan

Canoo reported it had yet to build any vehicles as of the end of the third quarter, and that it had $6.8 million in cash with access to $200 million through an at-the-market offering. It also saw a $117.7 million net loss.

During a third quarter call, CEO Tony Aquila revealed his company’s new manufacturing plan, the latest of several he’s touted over the past year.

First, Canoo was set to rely on partner VDL Nedcar for production. Then, it planned to build its own cars at its plant in Bentonville, Arkansas this year, and at its second factory in Pryor, Oklahoma in 2023.

Now, Canoo says it is working with partners to start production on November 17. It announced it is buying an existing plant in Oklahoma, where it will ramp up production in the second half of next year. The Pryor location will come into play later.

In the months since Canoo landed its deals with NASA and Walmart, the company signed binding agreements with fleet leasing provider Zeeba for 3,000 EVs and from work van rental company Kingbee for 9,300.

“We’re taking a disciplined phased expansion approach to bringing on capacity based on committed orders,” Aquila told investors. “This is now proving to be a very good move for us since the economy is now more turbulent and it’s more difficult to sell vehicles one at a time.”