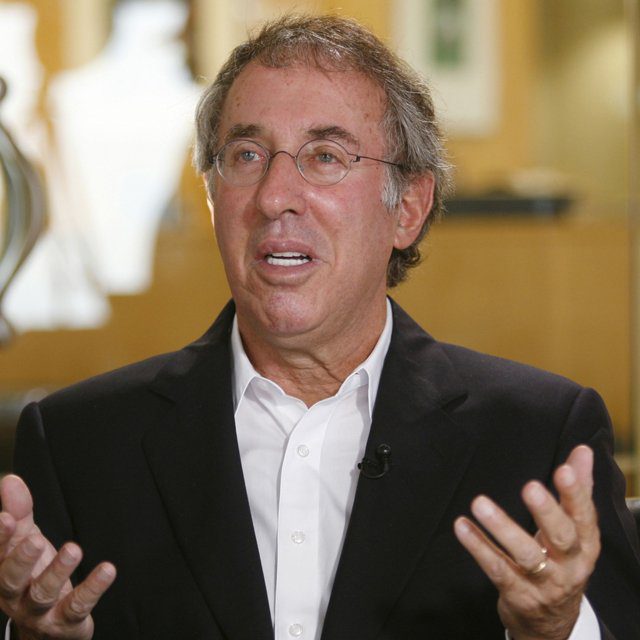

Baron Capital's Billionaire CEO: 'This Is a Great Time to Invest'

The U.S. stock market has come through tough times before, including the 1960s, which were marked by the Cuban missile crisis and multiple political assassinations, Baron noted. The Dow Jones Industrial Average hit roughly 800 in 1982, and “it’s now 32,000,” he added.

Early in his career as a stockbroker in the inflationary 1970s, Baron said he invested in companies whose stocks declined even as the businesses grew in value.

“In the 1970s, the ideas that I’m selling, they’re making money, because the companies that we’re investing in, they kept growing through it all,” he said, citing Disney, McDonald’s, Federal Express, Nike, Mattel, Hyatt and Tropicana.

This experience, however, turned him to a long-term investing philosophy.

“I wouldn’t have been able to make a living if I was just being a long-term investor in the 1970s. I needed commissions. And so I would get people to buy one stock and then they would double or triple and then they would sell it to buy my next idea. So sell Nike to buy Hyatt,” Baron told CNBC outside his firm’s annual investment conference in New York.

“And what would happen is I looked back after 10 years, 15 years, and I said, ‘Man, I’m a disaster; look at all these companies I recommended selling and look what happened. I could have been rich.’ … They’re up 30 times, 20 times, 50 times. So that’s what happened. That’s how we became a long-term investor.”