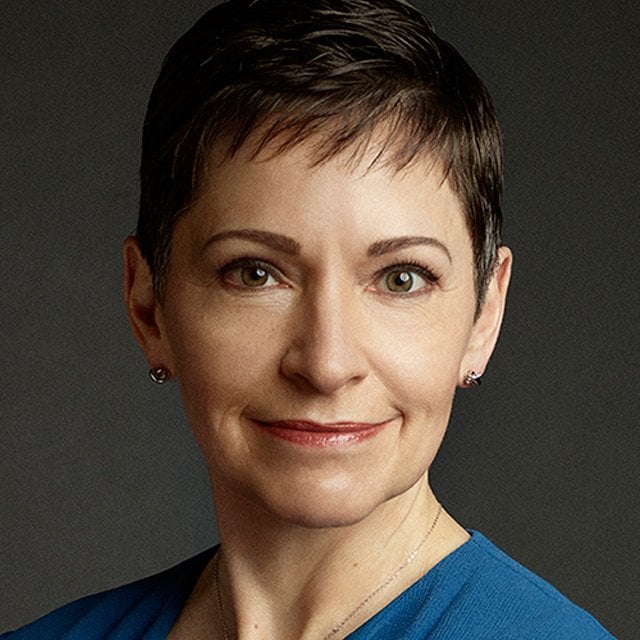

Penny Pennington Elected to FINRA Board of Governors

Pennington joins the FINRA board at a dynamic time for the self-regulatory organization. Just this month, FINRA’s enforcement arm issued its first disciplinary sanction related to the Regulation Best Interest. Separately, FINRA’s National Adjudicatory Council just raised the fine ranges for mid- and large-size firms and created separate sanction guidelines for individuals and firms. Sources say this move represents one of the most significant revisions to the FINRA Sanction Guidelines in decades.

Among other notable projects, FINRA is also in the process of revamping its continuing education program, such that broker-dealers and their reps face substantial new CE requirements starting in January, with courses likely to drill down on Reg BI.

According to the FINRA statement, the special meeting was called to fill the large-firm governor seat vacated by Christopher Flint upon his resignation in June. FINRA’s Board of Governors currently has 22 total members, with 10 industry members, 11 public members and one seat reserved for FINRA’s CEO.

The 10 industry governors include three from large firms, one from a medium-size firm, three from small firms, one floor member, one independent dealer or insurance affiliate, and one investment company affiliate. FINRA governors are appointed or elected to three-year terms and may not serve more than two consecutive terms.

Alongside Pennington, a public governor, Fabiola Arredondo, is also now joining the Board of Governors. Arredondo’s appointment to the FINRA board was announced in December.