Insurance Is Human

Almost a year ago, I felt impelled to bust the cliché that insurance is boring. In that blog post, I called out the idea that any industry that touches every imaginable peril individuals, families, businesses, and communities face could reasonably be considered dull.

Today – as I dig back into work after spending two days at the Society of Insurance Research (SIR) annual conference in Las Vegas – I feel similarly impelled to take on a different myth: That, because of its focus on statistical analysis and the dollars-and-cents aspects of risk, the insurance industry is out of touch with day-to-day human concerns.

I get it. I’m no one’s quant. Until becoming immersed in this big-numbers industry, I probably shared this perspective. I might even slip back into it from time to time, when the conversations become a bit too actuarial for my all-too-verbal nature.

In his opening remarks, Mike Meyers, SIR president and lead competitive analyst at USAA, used a phrase that the cynic in me thought a bit hokey. He referred to the conference – the first major in-person event for SIR since the pandemic – as a “family reunion.” As the event proceeded, though, it really did feel that way. This was my first in-person SIR event, but it quickly became clear that wasn’t the case for most of the attendees. The warmth and familiarity among the 200-plus participants was palpable.

Now, this was a gathering of insurance industry researchers, so, of course, there was going to be a lot of “numbers talk” and discussion about “leveraging technology to improve loss experience,” and so forth. But the human dimension was never far from any of the panels or one-on-one conversations. Whether the topic was online life and health insurance shopping; the challenges of researching diversity, equity and inclusion (DEI) in insurance; or how COVID-19 has affected the risk profiles of small businesses, nothing was abstract or soulless about these conversations.

Two bits that particularly struck me:

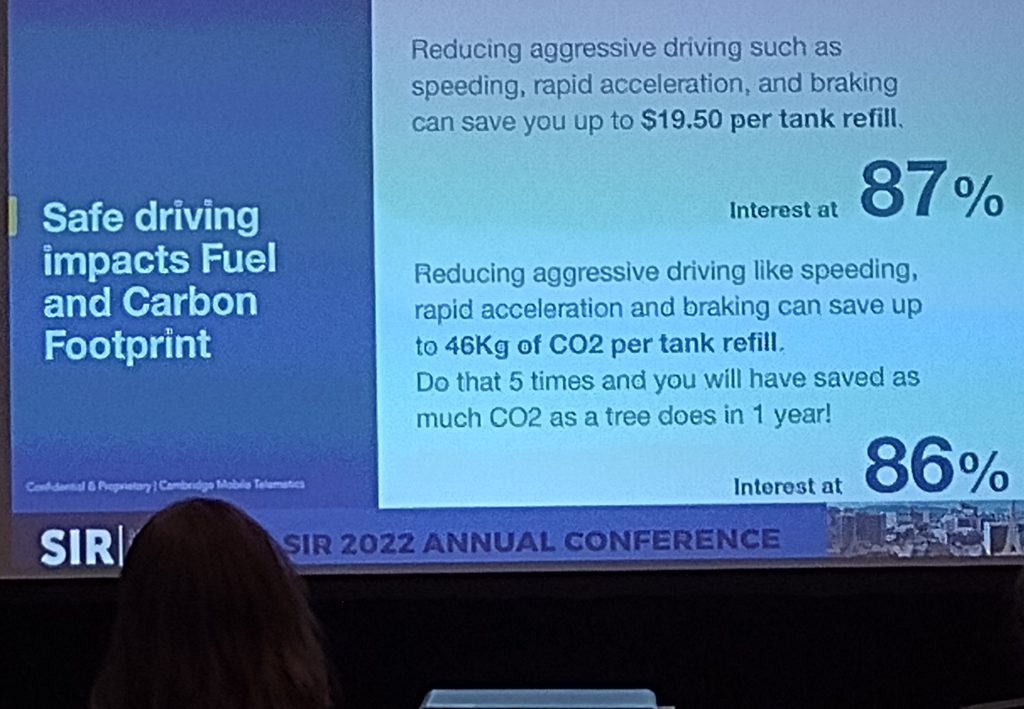

In a discussion of automobile safety data, a correlation was drawn between driving-safety and fuel-consumption stats. It was just one chart underscoring the fact that safer drivers use less fuel, which, in turn, has a positive impact on the environment. It’s not a big jump from there to the fact that automobile telematics technology – which helps insurers more accurately price coverage and creates financial incentives to drive more safely – also helps reduce emissions. Who doesn’t want to save money AND the planet?If you’ve ever had to replace an entire ceiling (I have!) because of a long, slow, undetected leak upstairs, the presentation on smart plumbing would have excited you as much as it did me. More inspiring, though, was the win-win strategy implemented by the insurer, which provides the easy-to-use technology to the policyholder for free and pays for a plumbing inspection if the diagnostic app flags a possible leak. Future big claim deterred for the insurer, massive headaches prevented for the homeowner!

I may not be an actuary or a data scientist or an economist – or possess any of the extraordinary quantitative skills insurance is known for – but I’m glad the industry marshals and rigorously applies these resources to such homey challenges, at scale.