The Going Grey Guide to Getting Life Insurance When You’re Over 40

So, you’ve done it. You’ve hit the big four-oh-no – welcome to the club!

Where did that time go?

Sure wasn’t it only last year that Jackie Charlton was leading the Irish team to glory, or Johnny Logan was asking all of Europe to hold him now?

Suddenly, you’re worrying about impending piles and hair loss (or, even worse, growth).

But even darker things are gnawing at your conscience. As a 40-year-old Spiderman probably says,

with great age comes great responsibility (and a touch of arthritis in your knees).

Life Insurance at 40

To quote the aforementioned Johnny Logan, “what’s another year?” As it so happens, waiting another year can make a big difference to your Life Insurance policy, especially as you creep towards 50.

Why?

Age, my fortied friend, I’m sad to be the one to break it to you, but death is edging closer, so you’re a bigger risk for a life insurance company than a person in their 30s.

Once you hit 50, you could pay four times more than if you got on the insurance train earlier because the risk of a claim increases as you creep towards 50.

In a nutshell: it’s worth getting it sorted as soon as possible for peace of mind and pocket.

So, where do you start?

What types of Life Insurance do you need at 40?

1. Mortgage Protection

You’re legally obliged (a nice way of saying ‘made’) to have Mortgage Protection if you get a mortgage in Ireland. If you die before clearing your mortgage, the provider will pay off what’s owed.

If you have a family, they’ll get a mortgage-free home which is handy, but they will lose your income.

You see, mortgage protection won’t leave them a lump of money to replace your earnings. That’s what life insurance is for…

2. Life insurance

The big cannoli of insurance: if you die, your financial dependents get a lump sum that they can dip into to replace your income.

If you’re dead, you’re not earning unless you can get a job as a poltergeist in the next world. Try justifying that to your spouse as the reason for not getting life cover.

But what if you don’t actually die, but you fall ill and can’t work – a much more likely event as you get older – can you insure against that?

Yessiree Bob.

3. Income Protection

If you cannot do your job for more than four weeks due to any medical recognised condition, Income Protection (sometimes called Salary Protection) pays you a replacement salary of up to 75 per cent of your income. It will continue to pay out until you get back to work or retire.

But it’s not all about staying out of work and getting “free money”, trust me, you’ll soon get bored. The best income protection policies include rehabilitation and retraining benefits so you can return to work and feel like you’re contributing to society again.

This one is particularly relevant if you’re a high earner on a solid career path. If you got sick, what would you miss out on, and how would your lifestyle suffer? Say goodbye to impromptu weekend ski trips, anyway. You’ve worked bloody hard to get where you are in your career, don’t let illness rob you of your dignity and pride. Nobody wants to become a financial burden – income protection ensures you won’t.

Finally, let’s look at the final type of cover available

4. Serious Illness Cover/Specified Illness Cover/Critical Illness Cover

Serious Illness Cover is similar to Income Protection because it pays out while you’re above the ground. Think of life insurance and mortgage protection as death insurance, income protection and serious illness coverage are living insurance.

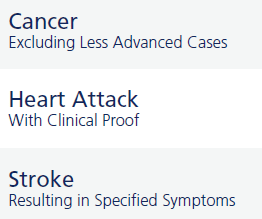

Serious illness cover pays a tax-free lump sum if you get any of the illnesses covered in the policy. Currently, there are 98 illnesses covered but 80% of all claims come from the big three:

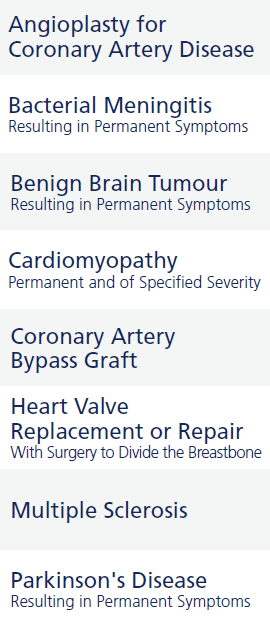

The next eight serious illnesses altogether account for approximately 17% of all claims paid

So the other 87 illnesses account for just 3% of all claims. What I’m trying to get at is don’t be blind-sided by the insurer shouting about covering the largest amount of illnesses. You need to find the insurer that offers the widest definition for the Big 8 illnesses outlined above.

What’s the best Life Insurance deal?

Let’s get this out of the way: while Life Insurance is magic when your family needs it most, it’s a pain in the arse when you’re coughing up the cash every month, so you want to ensure you get the best one. But is there a “best” life insurance provider?

There’s no magic bullet policy for everyone. Your personal situation is unique, so it really does depend. And that’s what makes brokers so handy? They can recommend a suitable level of cover based on your own individual circumstances.

However, we do have one guiding question for you:

Should you go with a bank, a broker, or straight to the source?

Life is short, so let’s fire through this one.

The sole advantage of going with a bank is that you get to meet with an actual, living, breathing, hard-selling human instead of doing it at your own pace online. If this puts you at ease, then you should immediately stop reading and hit the bank, as we are 100% online and phone based. You’ll only see me in videos 🙂

However, as nice as having a face-to-face with someone, you may be about to get ripped off by that sharp suit.

Irish banks can only sell insurance from one company, so they’re a no-go for impartial advice or bagging a deal. Banks also have no underwriting safety net, so if a bank says no, that’s it from them; they can’t shop around to and try another insurer.

In other words, avoid the banks if you have any pre-existing health issues.

Going direct to an insurer puts you in a similar place because you’re limited to the Life Insurance products that the insurer offers, e.g. Aviva only sells Aviva products, and Irish Life only sells Irish Life products.

Top Tips for Getting Life Insurance in your forties?

A couple more tips for you if you’re still not convinced:

Don’t get the amount of coverage that you think you should get. Instead, budget for what you can actually afford. Your maths might suggest you need a policy over €1m, but there’s no point taking this is it’s unaffordable. You’ll just end up cancelling it. Head over here to determine how much life cover you really need.

Consider the term you’ll need. Generally, this ties in with the age of your youngest child, so don’t go and buy whole of life or 40-year cover when a 25-year cover will do just fine. Your kids only need protection until they can stand on their own two feet (financially, not physically)

Don’t disregard reducing life insurance as a way to protect your family. It costs less than level-term life insurance, so you can buy more of it initially. This works because you need more cover now when you have more years to retire / more future income to replace.

To recap: shop around; get it sorted asap; if you have a family, you need Life Insurance.

You need personal income protection if you don’t have income protection through work.

Capiche?

Over to you…

If you’re stuck for time and want to get covered with the least amount of hassle, please complete my financial questionnaire, and I’ll be right back with a personalised recommendation.

Prefer a quick chat first; I’m on 05793 20836.

Still on the fence? Why not check out our free Guide to Life Insurance cover.

It goes without saying that everything we discuss will be in strict confidence… but I’ll say it anyway, just to be sure.

By the way, this is what you should have done in your 30s…I hope you’re not back here in your 50s looking for help 🙂