How a bot can solve a lot in insurance

About that bot – you can even name it.

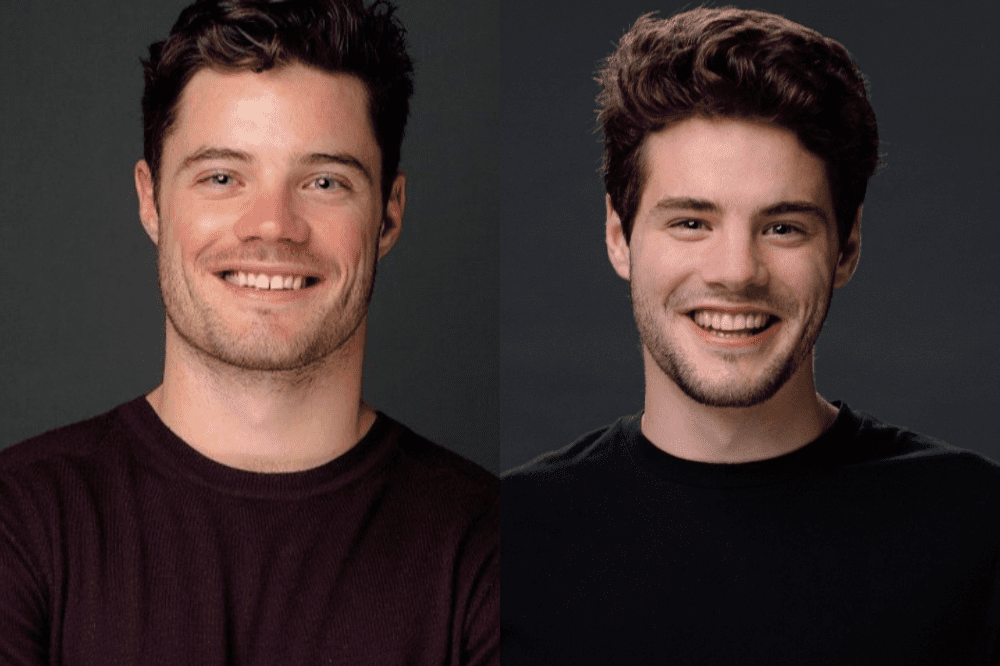

That’s the basic premise behind the company that co-founder and CEO Jackson Fregeau (pictured top left) launched in late 2020 with his younger brother (and software developer) Jamieson (pictured top right).

The startup, based in Vancouver, Canada, incorporated in November 2021 and nailed down its first customer two months later, after pivoting solely to the insurance space. Jackson Fregeau said he and his brother began their company with an initial focus on the technology uncertain where it would fit best.

“We were working with industries that had high volume … operations – law, healthcare, insurance retail, financial services,” he said during the Applied Net 2022 conference on Oct. 3. “After working with our first couple of insurance brokers, we realized pretty quickly how massive a pain point there was around this kind of work in the insurance industry, and that nobody else was solving it and it wasn’t going away, not even anytime soon, but not going away at all.”

Seed funding and growing

The company recently nailed down $1.5 million in seed financing from investors in Canada and the US,” Fregeau added.

With nine employees, it’s already attracted 30 customers, seven of which are in the United States. Typical customer targets include mid-sized insurance agencies or brokerages.

“When I say mid-size, 50 to 120 employees or so is our sweet spot right now,” he said.

Brokers and agents are logical targets for the technology, in part because of the large volumes of work they handle, Fregeau explained.

“If you look at a broker or agent … their entire operations are basically processing high volume transactions … they deal with hundreds or thousands of transactions every single day,” Fregeau said, through their broker or agency management systems. But those systems, he added, still require teams of people to process those transactions, whether it involves documents or renewals.

“Up until the last couple of years, automation capabilities haven’t really been able to automate a lot of these processes until the [robotic process automation] and intelligent automation technology really started to improve,” he said. “What it means is that you can now put this automation in place that can save brokers massive, massive, massive amounts of time.”

Quandri is initially focused on agents’ and brokers’ daily download of policies they service. Anywhere from 5% to 20% of them fail to find their way to the correct account, requiring manual corrections and many wasted minutes to correct. The initial launch bot will automate that process, Fregeau said.

Intelligent automation

The company’s software bots interact with a client’s user interface, logging in with username and password, reading the screen and navigating with the same functionality that a human user does, Fregeau said.

“It clicks, it types, it reads the screen. It navigates using the same functionality that you do and, importantly, that means it also goes through the process the same way that you do so you don’t need to change the bar,” Fregeau said. “A broker doesn’t need to change, or process, or re-engineer anything like that. A bot can run on these existing processes.”

Customers integrate the bot into their systems to automate client processes. There are three bots to choose from right now. Once integration is complete, the company trains the bot on client data sets.

Clients can also name their bots. One chose a name that is a slight variation on “Optimus Prime,” a robot from The Transformers toy and movie franchise, Fregeau noted.

As Fregeau describes it the bot’s robotic process automation technology is the “hands and feet” that moves everything around, clicking and navigating the screen. The AI is the brain of it. The programming revolves around PDF recognition, enabling the bots to extract data out of PDF and policy documents, and machine learning helps to do this in a scalable way.

Jamieson Fregeau, the company’s co-founder and president, has a background in software development, and helped establish Quandri’s core technology over the last two years. He said he was surprised to learn that many insurance industry processes among agents and brokers are still manual.

“The most surprising thing is that these processes are still done by people,” the younger Fregeau said. “The scale at which we’ve seen that has probably been the most surprising thing to me.”