Cat bond fund index sees biggest fall in history on hurricane Ian

The Plenum CAT Bond UCITS Fund Indices have fallen by the largest percentage in their history after hurricane Ian, driving home the significant mark-to-market losses driven by the storm, as well as the expectation the cat bond market faces its largest single event losses on record.

As we’ve been documenting, hurricane Ian is expected to cause losses to a number of catastrophe bonds, while the immediate mark-to-market decline in cat bond prices was particularly broad after the event.

With one of the benchmarks of the catastrophe bond market falling significantly after hurricane Ian made landfall, in the Swiss Re cat bond index, it became clear that catastrophe bond funds would experience a relatively significant decline.

Now, we have the latest data available on UCITS cat bond funds and how they’ve fared after hurricane Ian, thanks to the Plenum CAT Bond UCITS Fund Indices.

These catastrophe bond fund indices provide a valuable source of real cat bond fund return information across the UCITS cat bond fund category, with 14 live cat bond funds currently tracked and calculated.

As a result, the index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

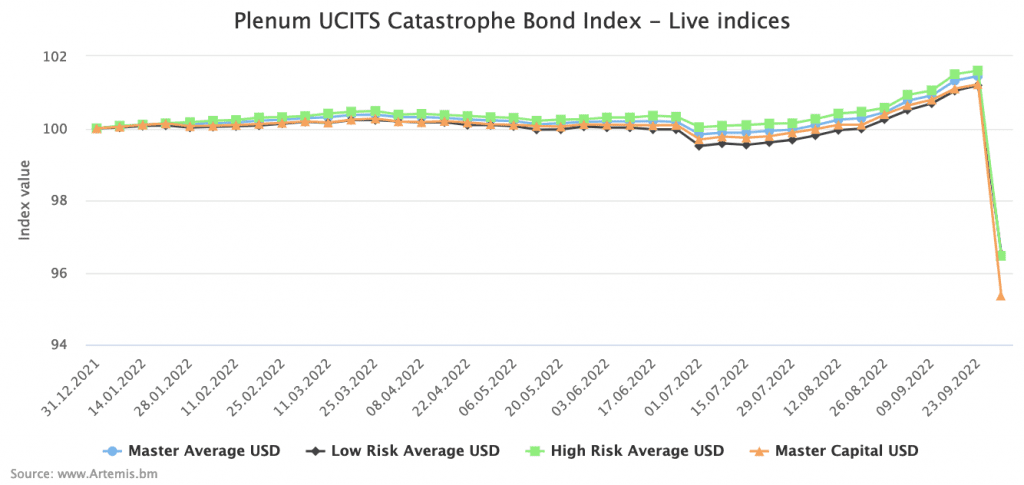

The first thing to note is that our forecast of a roughly -3% to -9% performance spread for the cat bond market after hurricane Ian matches the experience of this basket of UCITS cat bond funds, which actually experienced a spread of -1.5% to -9%.

This reflects the diverse range of cat bond fund strategies available, with different risk and return targets, showing how cat bonds now provide a healthy range of investment choices for allocators.

Onto the cat bond fund index itself, as these have seen an average decline of just over -5%, the biggest single decline in their history.

With such a steep decline, the live cat bond fund indices, which only track back to the end of 2021, appear decimated in our chart (click the image for the interactive version).

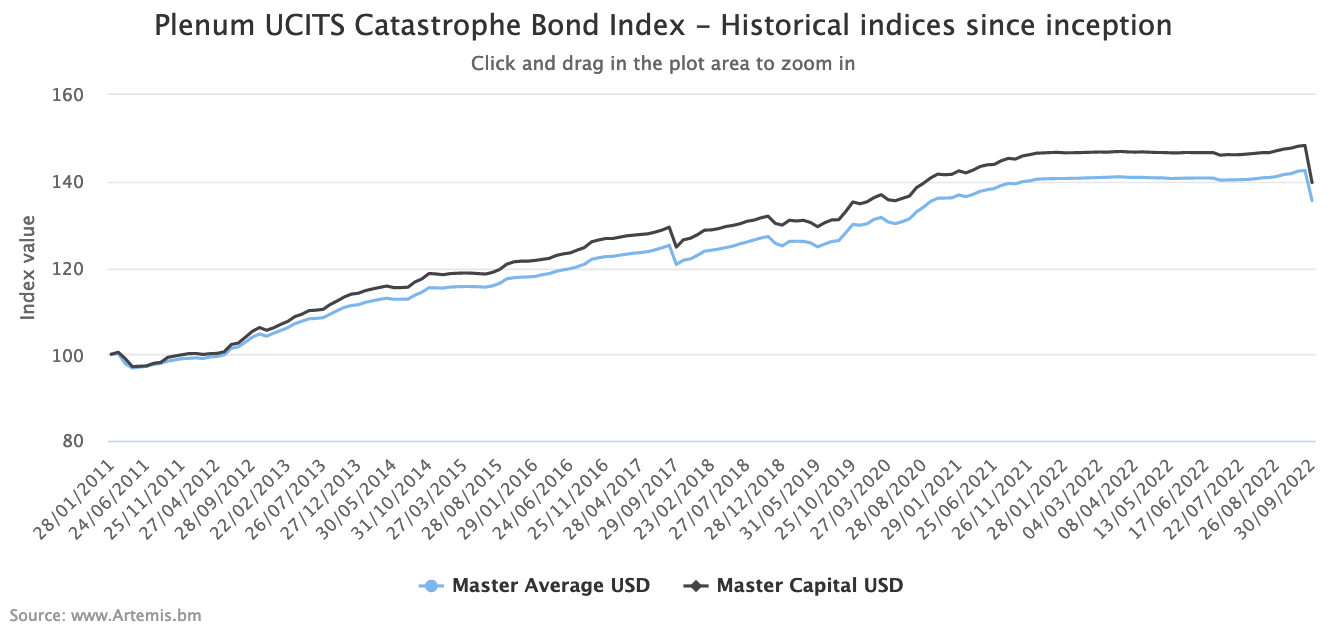

For a better idea of the impact hurricane Ian has had on the catastrophe bond fund market, our historical indices that track UCITS cat bond fund performance back to 2011, provide a clearer view (click the image for the interactive version).

The two Plenum CAT Bond UCITS Fund Indices that we have historical data on, the Master Average and Master Capital, have fallen by -4.89% and -5.79% respectively.

By risk level, the Low Risk Average cat bond fund index fell -4.61% and the High Risk Average by -5.06%.

Looking at the Master Capital cat bond fund index from Plenum, its biggest previous fall, before hurricane Ian, was in late September 2017 after hurricanes Harvey, Irma and Maria had made their landfalls.

The Master Capital cat bond fund index at that time fell by -3.56%.

So, cat bond fund performance has been much harder hit by hurricane Ian than even those three major hurricanes, the main reason for which is of course the significant insurance and reinsurance industry losses expected from hurricane Ian.

It’s going to be interesting over the coming weeks to see how these cat bond fund indices move, as there will be some recovery of marked down prices for certain cat bonds, where it turns out hurricane Ian may not have cause a significant loss, but some other bonds are likely to move further down as actual losses become clearer for them.

So we could see some fluctuation in the cat bond fund index as the ramifications of hurricane Ian move through the market and funds realise their true exposure to this major industry loss event.

Finally, it’s worth recognising that numerous large global reinsurance companies have seen their share prices fall more than 10% since hurricane Ian, while some other ILS strategies, such as the mutual funds that invest in quota share reinsurance and collateralized reinsurance instruments, are also down much more than the cat bond market.

A roughly -5% decline for the cat bond market, after a hurricane hits the peak zone exposure of Florida which could cause anywhere north of $50 billion of insured losses, seems an expected reaction for cat bond funds, given the disaster insurance capital they provide.

Analyse these UCITS catastrophe bond fund indices here.

Read all of our coverage of hurricane Ian, and our analysis on the potential market losses, here.