10 Most Affordable States for 2023 Medicare Advantage Plans

Start Slideshow

What your Medicare-eligible clients spend on Medicare coverage in 2023 could be about the same as what they’re spending this year.

The projected average premium for 2023 plans is $18 per month, down 8% from the average for 2022 coverage, according to officials at the Centers for Medicare and Medicaid Services, the division of the U.S. Department of Health and Human Services that runs Medicare.

A ThinkAdvisor analysis of the 2023 plan cost spreadsheets suggests that, once a plan’s prescription drug deductible and annual maximum out-of-pocket spending limit (MOOP), is taken into account, a client’s spending may fall to about $1,100 per year, from about $1,200 per year.

To see which states will have the lowest projected annual Medicare Advantage plan costs, including premium, prescription deductible and out-of-pocket spending on medical bills, see the gallery above.

For data on all 50 states and the District of Columbia, see the table below.

What It Means

Typical clients who buy Medicare Advantage coverage may average about $1,100 per year in premium, deductible and MOOP costs, and some with serious health problems could face up to $8,300 in bills, even if they are careful about seeing in-network doctors.

A new Gen Re analysis of the Medicare supplement insurance market — the Medicare Advantage market’s smaller, older sibling — shows that clients are paying an average of about $2,400 per year for Medicare supplement insurance coverage, on top of about $2,700 or more for Medicare Part B premiums and $226 for the Medicare Part B deductible, for a total of more than $5,300.

Medicare

Medicare is a federal program that pays for care for people ages 65 and older, some people with severe kidney disease and some people with disabilities.

CMS uses a combination of payroll taxes and enrollee premiums to pay for the program.

Private insurers can participate by offering Medicare Advantage plans, or plans that look to the enrollee like alternatives to “original Medicare” coverage, or by offering Medicare supplement insurance policies, which can fill the many holes in original Medicare’s Medicare Part A inpatient hospitalization coverage and Medicare Part B physician and outpatient services coverage.

About 29 million people have Medicare Advantage plan coverage, with 17 million of those enrolled in health maintenance organization plans, 12 million in local or regional preferred provider organization plans and 42,175 in private fee-for-service plans, according to Medicare Advantage plan enrollment data for August.

Gen Re found that 5.4 million people had Medicare supplement insurance coverage in 2021.

Medicare supplement insurance has an enrollment period system tied to a consumer’s 65th birthday anniversary.

The annual open enrollment period for Medicare Advantage plan coverage runs from Oct. 15 through Dec. 7.

Cost Estimates

Medicare Advantage is a complicated program, and making apples-to-apples comparisons of plans’ benefits and costs is difficult.

About 38,631 of the 68,853 2023 Medicare Advantage HMO or PPO that offer prescription drug benefits have a $0 monthly premium.

But the kinds of affluent, risk-conscious people who work with insurance agents and financial advisors may strongly prefer plans that charge a monthly premium and may offer access to broader provider networks.

At the 30,222 2023 HMO and PPO plans with a monthly premium over $0, the median monthly premium is $22, and the median prescription drug deductible is $464. The median MOOP is $5,5500.

That compares with a median monthly premium of $49, a median drug deductible of $295 and a median MOOP of $5,900 for similar 2022 plans.

To try to minimize the effects of plan benefits changes on cost comparisons, we calculated state cost averages based on a somewhat narrower set of plans: HMO or PPO plans with a monthly premium, with what CMS classifies as enhanced drug benefits, and with at least coverage in the “donut hole,” or gap between the end of benefits for ordinary drug expenses and the start of catastrophic drug benefits.

For 2023, those plans have a median monthly premium of $17, a median drug deductible of $68, and a median MOOP of $5,357.

That compares with a median monthly premium of $26, a median drug coverage deductible of $141, and a median MOOP of $5,000 for 2022.

CMS assumes when computing MOOPs that about 15% of the Original Medicare enrollees will face $3,400 or more in out-of-pocket medical bills in a given year.

We came up with a rough estimate of annual care costs by adding annualized premiums to the drug deductible, along with 15% of the MOOP.

That method produces estimated 2023 client costs of $1,076, down from $1,197 this year.

The projections range from less than $500 in one state to more than $1,800 in Maryland.

Reasons

One reason for Medicare plan price stability may be tough competition in the market, and another may be the effects of extra federal subsidies and fluctuations in claims related to the COVID-19 pandemic.

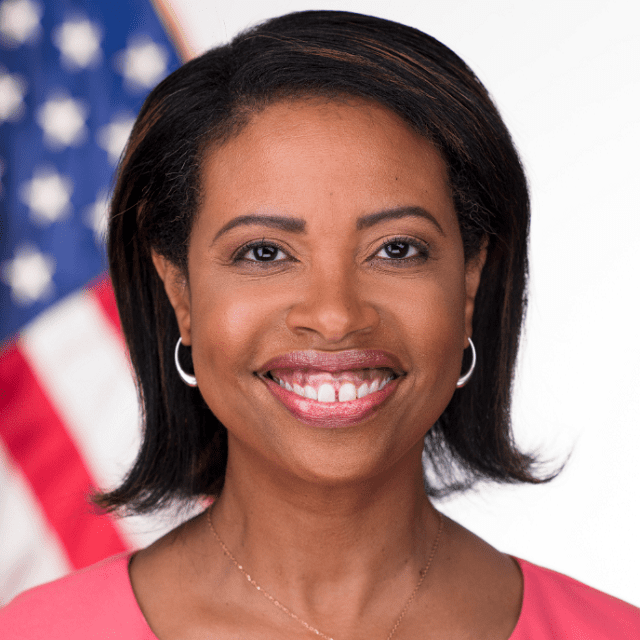

CMS Administrator Chiquita Brooks-LaSure said the drug cost control provisions in the new Inflation Reduction Act may already be having some effect on coverage costs.

“It is more important than ever for people to review their health coverage and explore their Medicare options during open enrollment this year,” she said.

2023 Medicare Advantage Plan Costs

This chart includes HMO and PPO plans that offer enhanced prescription drug benefits, including at least some benefits in the “donut hole.”

Organization

Average monthly premium)

Average annual drug deductible

Average in-network annual maximum out-of-pocket spending limit

Average estimated annual costs

Alabama

$17

$46

$4,775

$966

Arizona

$5

$28

$4,083

$706

Arkansas

$12

$148

$5,494

$1,115

California

$23

$25

$3,001

$749

Colorado

$9

$7

$5,213

$901

Connecticut

$21

$139

$6,187

$1,319

Delaware

$12

$7

$6,116

$1,068

District of Columbia

$28

$38

$6,588

$1,358

Florida

$5

$36

$3,380

$602

Georgia

$12

$83

$6,258

$1,169

Hawaii

$61

$62

$5,322

$1,588

Idaho

$21

$84

$5,838

$1,215

Illinois

$19

$15

$3,566

$776

Indiana

$16

$25

$4,470

$884

Iowa

$29

$24

$4,429

$1,031

Kansas

$4

$14

$3,887

$647

Kentucky

$11

$27

$5,369

$961

Louisiana

$18

$83

$5,586

$1,136

Maine

$19

$182

$6,006

$1,314

Maryland

$58

$94

$7,140

$1,856

Massachusetts

$47

$198

$5,784

$1,633

Michigan

$36

$21

$4,534

$1,134

Minnesota

$89

$70

$3,763

$1,701

Mississippi

$8

$191

$5,903

$1,170

Missouri

$11

$12

$3,468

$663

Montana

$37

$119

$4,792

$1,278

Nebraska

$2

$33

$4,692

$761

Nevada

$5

$2

$2,623

$458

New Hampshire

$27

$237

$6,680

$1,565

New Jersey

$12

$157

$7,263

$1,396

New Mexico

$11

$108

$5,544

$1,067

New York

$53

$161

$6,839

$1,829

North Carolina

$11

$75

$4,956

$948

North Dakota

$17

$185

$4,678

$1,091

Ohio

$32

$56

$4,826

$1,168

Oklahoma

$8

$25

$4,977

$871

Oregon

$48

$78

$5,357

$1,453

Pennsylvania

$50

$53

$6,050

$1,557

Puerto Rico

$5

$0

$4,102

$670

Rhode Island

$39

$68

$5,192

$1,314

South Carolina

$6

$75

$6,323

$1,094

South Dakota

$3

$68

$4,258

$740

Tennessee

$13

$19

$5,404

$981

Texas

$8

$65

$4,586

$855

Utah

$14

$68

$5,904

$1,124

Vermont

$34

$83

$6,663

$1,490

Virginia

$17

$96

$6,185

$1,234

Washington

$33

$48

$5,805

$1,314

West Virginia

$10

$83

$6,774

$1,224

Wisconsin

$35

$123

$4,279

$1,180

Wyoming

$29

$92

$6,500

$1,419

MEDIAN

$17

$68

$5,357

$1,134

Pictured: CMS Administrator Chiquita Brooks-LaSure (Photo: CMS)

Start Slideshow