ILS fund market return in August 2022 was highest for 23 months

Insurance-linked securities (ILS) and catastrophe bond funds, as a group tracked by ILS Advisers and Eurekahedge, have delivered their highest monthly return in almost two years in August 2022.

The average return of insurance-linked securities (ILS) funds was a positive 0.68% return for August 2022, according to the Eurekahedge ILS Advisers Index.

The last time this ILS fund index recorded a higher monthly ILS fund return was back in September 2020.

By the end of August 2022, the year-to-date return of ILS funds tracked by ILS Advisers had reached 1.27%, running ahead of full-year 2021 already by that stage.

Of course, these ILS funds will be reporting very different numbers for September, as hurricane Ian mark-downs and expected losses will begin to be reported.

With no significant catastrophe events in August, the ILS funds have demonstrated their ability to deliver higher returns for the month.

Only one ILS fund reported negative performance, at -0.03% for August 2022, while the other 18 tracked were positive for the month.

Private ILS funds, so those that invest in collateralised reinsurance instruments, led the way in August 2022, with an average return of 0.81%.

Meanwhile, pure catastrophe bond funds reported an average return of 0.54%.

Our catastrophe bond fund index page shows that August saw an accelerated recovery in the cat bond market, which has helped to boost performance of the Eurekahedge ILS Advisers Index.

The best performing ILS fund for August 2022, of those tracked by ILS Advisers for this ILS fund index, reported a positive 1.98% return for the month.

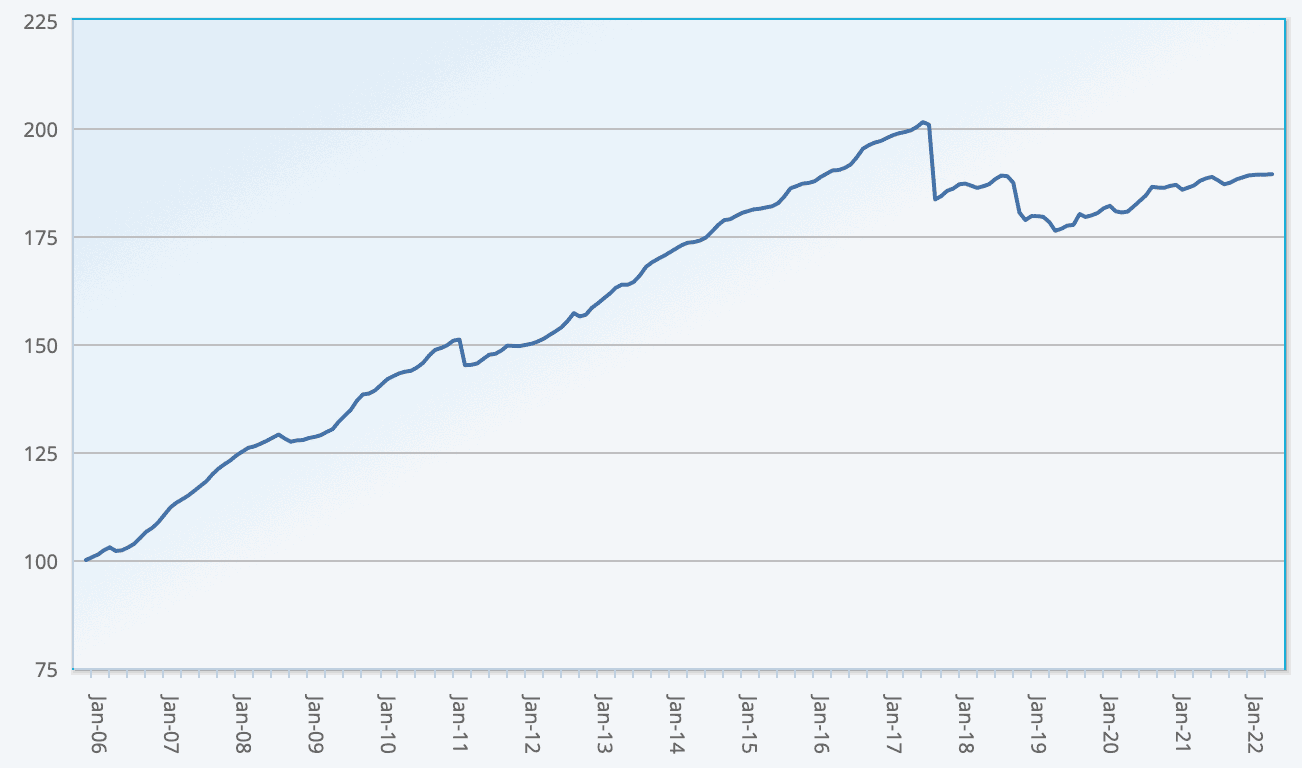

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 23 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.