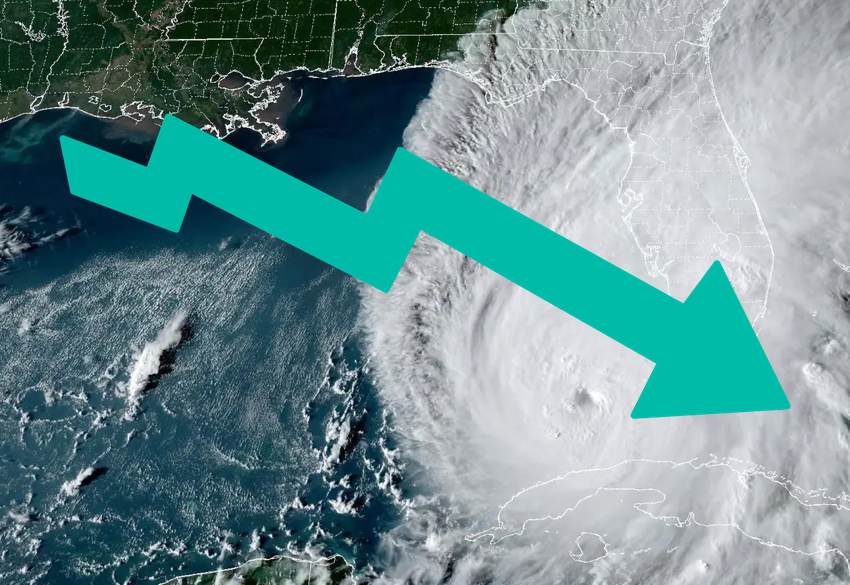

Stone Ridge mutual cat bond & ILS funds decline further on Ian

Another indication of the impacts of hurricane Ian for the insurance-linked securities (ILS) market is in how the publicly available net asset values of mutual catastrophe bond, ILS and reinsurance linked investment funds have been moving.

As we reported yesterday, some of the mutual ILS funds had tumbled on the approach of hurricane Ian, with Stone Ridge Asset Management’s strategies leading the way down.

The decline continued yesterday (as we suggested was likely in our article), with their marks at the end of the day showing another relatively steep drop for Stone Ridge’s two flagship mutual cat bond and ILS focused funds.

Stone Ridge’s Reinsurance Risk Premium Interval Fund continued to be the worst affected.

Having declined by 3.8% from mid-September to the mark available yesterday, this fund dropped a further 4.8% at the end of the day, so as of now is down 8.5% since before hurricane Ian became a threat.

Stone Ridge Asset Management’s other mutual ILS fund, the Stone Ridge High Yield Reinsurance Risk Premium Fund, which is not an interval structure and is largely catastrophe bond focused, was down 2.6% since mid-September as of yesterday.

As of today, having been marked again last night, this ILS fund of Stone Ridge’s dropped a further 4%, taking it to almost 6.5% down since before hurricane Ian threatened Florida.

There were no other notable movements among the other listed mutual cat bond, ILS or reinsurance linked funds yesterday.

It’s perhaps worth also noting that some of the insurance and reinsurance share price indices are also down considerably, in fact further than the Stone Ridge ILS funds, in some cases.

The Stoxx Europe 600 Insurance Index is now down almost 10% since mid-September, while the Solactive Global Reinsurance Index is down almost 7%, and finally the Dow Jones US Reinsurance Index had fallen by almost 7% as well, but has recovered slightly since.

Also read:

– Hurricane Ian economic loss in Florida around $65bn: RMSI.

– Hurricane Ian: A historic hit for Florida, no matter the quantum of loss.

– Hurricane Ian to impact cat bond funds. Plenum says hit to be “limited”.

– Hurricane Ian to add reinsurance rate momentum, disrupt Florida market: KBW.

– A particularly broad cat bond mark-down this Friday?

– Cat modeller data hinted at hurricane Ian’s $50bn+ industry loss potential.

– Hurricane Ian: Rapid weakening may see losses nearer $32.5b, says KBW.