Top Insurance Employers 2022

Jump to winners | Jump to methodology

Competing for top talent

Sponsored by:

Too many jobs and too few applicants have given Australia’s insurance industry employees the whip hand. The pandemic and the ensuing reactions have delivered extremely challenging conditions for hiring managers. Similar to other sectors of the economy, insurance job seekers have gained leverage due to government stimulus and the impact of two-year border closures. Jobs are being created at a pace that’s faster than the labour market can adapt to.

“Trying to recruit during the past two years has been very difficult,” says Anita Lane, director of Solution Underwriting, one of the Top Insurance Employers in 2022. “While the Great Resignation did not fully roll out in Australia like in the USA, we did see a war for talent in the labour market locally.”

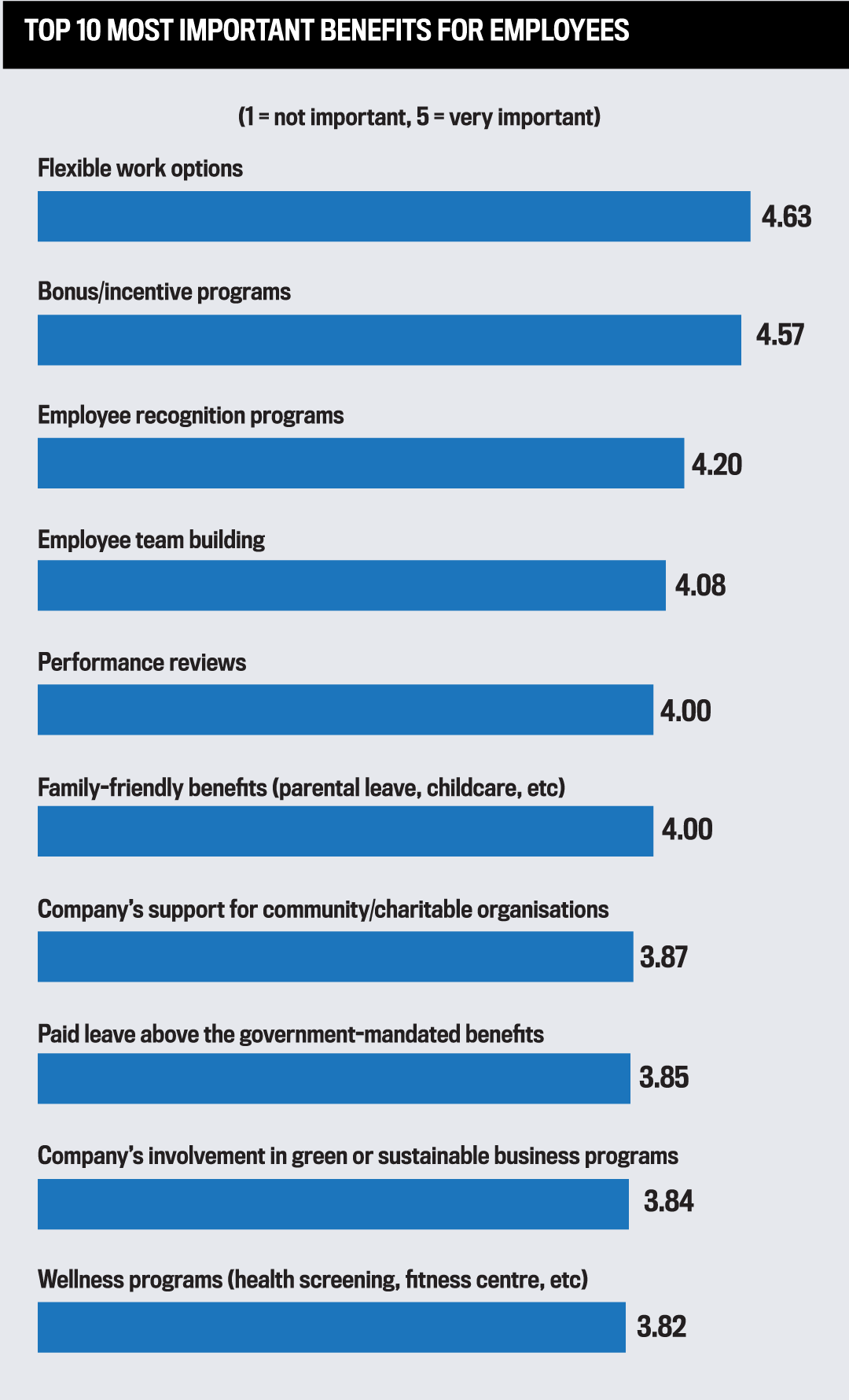

In a competitive labour market, companies are motivated to attract talent by offering more appealing conditions. To determine how some of the best insurance employers in Australia have been optimising their ability to attract top talent, we welcomed self-nominations from all insurance companies for the 2022 Top Insurance Employers survey. Then, we queried the organisations’ own employees on metrics such as benefits; compensation; culture; employee development; and commitment to diversity, equity and inclusion (DE&I) to determine the best of the bunch.

“While the Great Resignation did not fully roll out in Australia like in the USA, we did see a war for talent in the labour market locally. Trying to recruit during the past two years has been very difficult”

Anita Lane, Solution Underwriting

Solutions to the labour blockage aren’t easy fixes. For example, Brad Miller, general manager and co-founder of winner BizCover, is appealing for government assistance. He says: “Going forward, we see a continued shortage of labour supply across the board and hopefully the government and industry will be looking at that to relieve the current pressure and not constrain the growth we are trying to achieve.”

The devil is in the details. Australian National University professor Bob Breunig, a public policy economist, has spoken of how many older workers have left the workforce in general and are happy not to return. The government tried to counter this before with its mature age worker tax offset, a credit to encourage over 55s to remain employed. However, the program was unsuccessful and was scrapped in 2014. It seems logical to assume it would be an even tougher sell now.

Australia’s Reserve Bank anticipates inflation will hit 7% by the end of the year, while the Fair Work Commission has ruled minimum wages will increase by at least $40 a week. Clearly, increased wages will have a role to play, but there are other avenues companies can pursue.

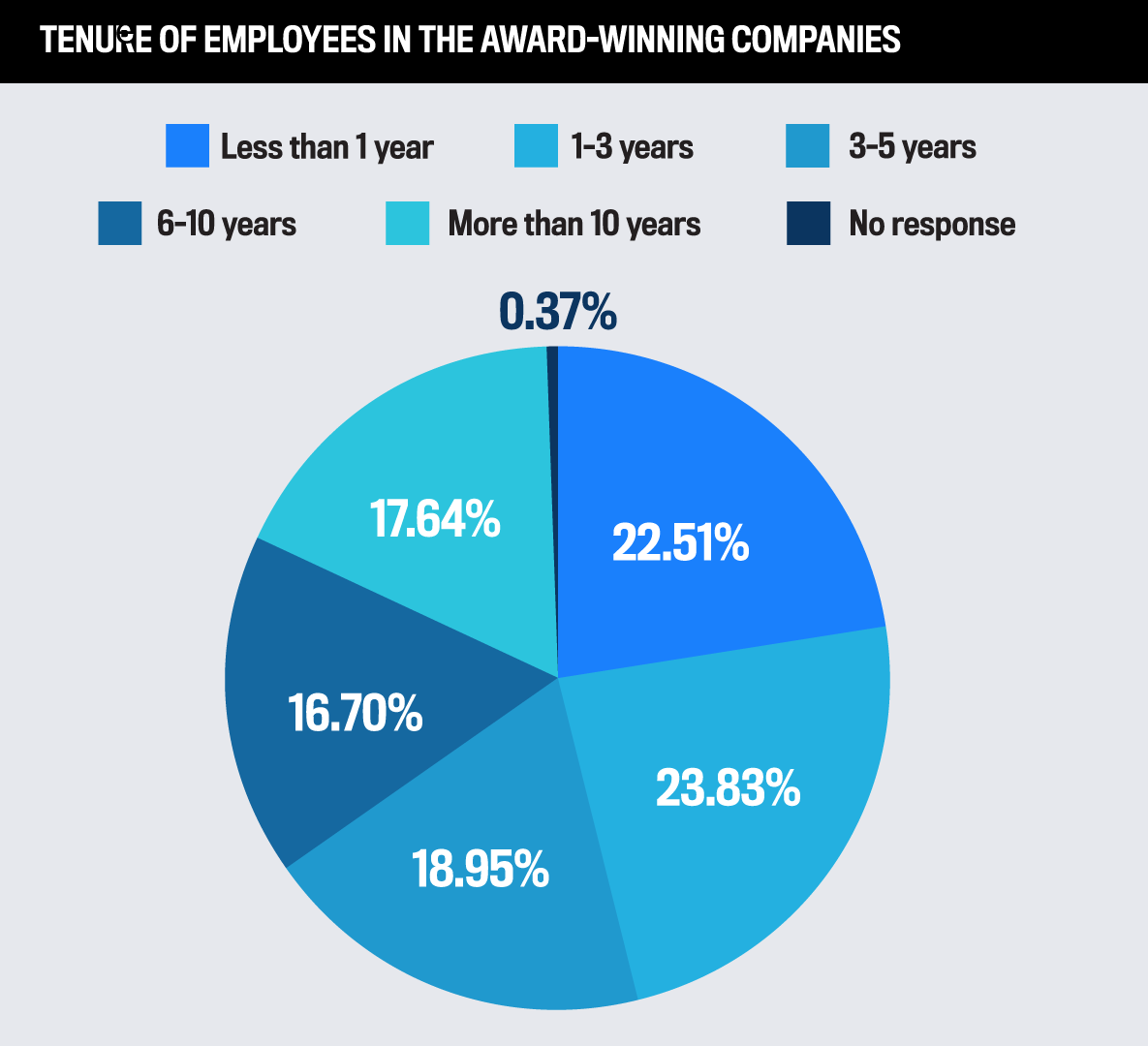

“With fewer candidates, we also must focus on retaining our staff. We want to upskill and set clear pathways for our teams in order to keep them fulfilled in their roles,” explains Lane. “But while it’s been a tough market to recruit in because there are so many great alternatives for people to go to across the broad spectrum of insurance roles from product and underwriting to technology, we believe our results show our BizHumans [BizCover employees] are thriving and want to stay.”

That mindset is echoed by fellow winner Rural Affinity’s risk and compliance manager, Lisa Beswick, who emphasises the need to foster adaptable working conditions. “People are placing a lot more weight on areas of flexibility, company culture and balance in general,” she says.

Generational convergence

Stereotypes based on age are outdated. No longer do older workers lack IT skills, while younger employees value work-life balance. Global insurance industry research conducted by Deloitte suggests the APAC region appreciates this relative to others, as 29% of their insurance talent officers stated it was completely up to employees if they wished to return to the office. This is compared to just 3% in Europe and 0% in North America. So how are the winners adapting to meet the diverse needs of their multi-generational workforces?

Beswick explains how it’s about tailoring conditions almost on a case-by-case basis, to allow employees to engage with what makes them more productive. She says, “All people want to feel valued, challenged and rewarded. People from all generations excel if you give them the space and support to choose their own adventure.” Several factors are part of her focus across Rural Affinity’s staff – “ambition, flexibility, independence, social conscience, curiosity, tech savvy, a thirst for knowledge and a desire for work-life balance are evident in individuals from each of the generational groups.”

Lane also highlights how generational categories are redundant. “Overall, employees are seeking career development and positive work cultures as a key determinate of employment, regardless of their generational group and characteristics,” she says. “I have worked with many people that contradict the characteristics of these identified generations – they are too broad and somewhat irrelevant if we employ the right people for the right jobs, not their age groups.”

“Overall, we want to recruit across all demographics: each of them brings a new perspective and opportunity particularly around customer experience and helping us innovate the way we do things”

Brad Miller, BizCover

Operation diversity

Any company looking to prosper is treating DE&I as a serious consideration. The challenge is that it’s not about only implementing processes but updating and maintaining them. The key to this comes from a top-down approach. “We continue to improve and work on changing the conversation within our business and in the wider industry,” says Lane. “We currently do this by boosting mentoring and coaching our leadership team, understanding that change cannot be expected within a business if it is not also reflected at the top.”

For Miller and BizCover, DE&I is all about visibility and understanding. “Our goal is to shine the spotlight on a wide variety of DE&I initiatives, making these projects always visible throughout the workplace,” he says. “Secondly and crucially, our other goal is to ensure our employees understand the importance of having a diverse workforce. Together this has intertwined diversity and inclusion into the very fabric of what it means to work for BizCover.” Examples of BizCover’s initiatives include recruiting for people with autism, acknowledging identity groups and celebrating everything from NAIDOC (National Aborigines and Islanders Day Observance Committee) Week to Women’s Day to the religious holidays of Diwali and Purim.

“[At Rural Affinity,] we have formalised policies and procedures on diversity, equity and inclusion, but without the right culture, policies become pretty ineffectual,” says Beswick. “We have always promoted and remunerated staff based on merit and achievement, we don’t lean towards a particular group. We’re pretty proud of the fact that our management/leadership team is made up of individuals with a diverse range of ages, with diverse backgrounds and 50% are women.”

“We have always promoted and remunerated staff based on merit and achievement, we don’t lean towards a particular group”

Lisa Beswick, Rural Affinity

Winning mentality

Ultimately, the Top Insurance Employers are doing things differently than their competitors. But what is it and why?

“We offer a collaborative work environment where employees are encouraged to be creative and instrumental in ‘how’ the business is managed,” says Lane. “We offer an excellence program to develop or enhance other soft skills. We offer training, development and mentorship to all employees across the business.”

As for BizCover, Miller adds, “Our culture blurs the line between hierarchies, which breaks down barriers between teams and encourages collaboration. There’s a lot of exposure and access to our executive team, which makes it easier and less intimidating to give and get feedback.”

Bjorn Meier, chief operating officer of BizCover, says, “People genuinely want to be here and contribute to the success of the business. People aren’t here for the ride; they’re here for driving, which I think is fantastic.” BizCover’s head of marketing, Sharon Kenny, highlights the diversity of roles in the company: “underwriting, technology to marketing, there’s a general diversity of people spread across the organisation. There is a sense of working together and not against each other and fostering a team spirit across all aspects of the business.”

Other initiatives that BizCover promotes are inclusion programs, recognition of different cultures, paid parental leave, learning platforms, and value awards.

“At Rural Affinity, culture is king,” says Beswick. “We’ve always fostered a positive, collaborative work environment. The strength of this culture was really underscored with our return to work after COVID lockdowns – the process for us was great with people happily returning at the first opportunity, keen to get back together.” In addition, she says the company focuses on people, prioritising internal and external relationships. Lastly, they don’t believe in resting on their laurels and are always looking to improve themselves.

From the Sponsor

We are the business that opens doors and makes introductions. From an idea to a national company with four major offices in 15 short months, Kona Recruitment (formerly Kona & Co.) is now a specialist insurance recruitment agency offering trusted advice from Australia’s most experienced insurance recruiters.

Sticking to our founding executive search roots, we advise the country’s top insurance employers on strategies for building senior and executive teams while also assisting experienced industry professionals with their next career move within the leadership space.

With a strong focus on supporting the next generation of talent in the insurance industry, we’re proud to be sponsoring Insurance Business Australia’s Top Insurance Employers 2022 report.

Having heavily invested in our corporate social responsibility program from April 2021 to July 2022, we’ve contributed over 20,000 meals to help Foodbank Victoria feed vulnerable Australians and have worked with Seven Clean Seas to remove over five tonnes of plastic pollution from our plant’s most polluted waters.

As winner of the 2021 (Q3) Recruiter Insider “Candidate Experience Award” and finalist in the 2021 Tiara Recruitment Awards ANZ for “Best SME Recruitment Company To Work For (1-15 Employees)” and “The Training & Development Award,” our company is recognised as a leading contender in the insurance recruitment space.

James Toth

James Toth

Managing Director

Kona Recruitment

500 or more employees

100–499 employees

AIG Australia

BizCover

DUAL Australia

99 or fewer employees

Brooklyn Underwriting

Elliott Insurance Brokers

Rural Affinity Insurance Agency

Solution Underwriting Agency

To find and recognise the best employers in the industry, Insurance Business invited organisations across Australia to participate by filling out an employer form outlining their various offerings and practices. Next, employees from nominated companies were asked to complete an anonymous form evaluating their workplace on a scale from 1 (poor) to 5 (excellent) on various metrics, including benefits, compensation, culture, employee development, and commitment to diversity and inclusion.

To be considered for the final list, each organisation had to reach a minimum number of employee responses based on overall size. Organisations that achieved an 80% or greater average satisfaction rating from employees were named Top Insurance Employers for 2022.

This special report is proudly sponsored by Kona Recruitment.

94% of employees are satisfied with the culture of their workplace, about the same as in the 2021 report

85% of employees are satisfied with their overall compensation, down 3% from the 2021 report

75% of employees are satisfied with their company’s healthcare benefits, up 6% from the 2021 report