How Much Should You Spend on Life Insurance?

How much should you spend on life insurance?

Like it or not, life insurance is a smart play for your family.

If you walk out in front of a bus, you’re gone, and so is your income that they depend on for their future financial stability.

But, you might be wondering how much should you spend on life insurance?

Are we talking about having to sacrifice nice days out with the fam, or just your regular morning caffeine hit?

These are totally normal questions, although it seems like hard and fast numbers are, well, hard to come by no matter how much googling you do.

However, how much you should spend is a really tricky question to answer.

A life insurance quote is going to be different for every person.

Your lifestyle, habits, health issues, and age and weight will affect how much you will pay for your life insurance policy.

But as I’m one of the soundest brokers you’ll meet

Am I really sound if I have to say I am?

I’m going to break it down as much as I can without actually knowing anything about you.

Sit back, relax, look into my eyes and prepare yourself for a really crappy knock-off of Keith Barry | Mind Magician

How much will life insurance cost me?

As I said, I can’t give you exact numbers.

You’re a stranger to me, I don’t know enough about you.

But, I do have a rather nifty life insurance calculator that can give you a personal quote.

Although beware, it still doesn’t ask enough questions to get a completely accurate quote.

Why?

As above

Your lifestyle, habits, health issues, and age and weight will affect how much you will pay for your life insurance policy.

Check out my article here that explains why you can’t 100% trust online life insurance quotes.

Anyways, back to the topic at hand.

And please, a huge round of applause as we welcome to the stage my young friend, Patrick.

Patrick is 46 years young, has never had a life insurance policy, and now that he has a family, he’s started to recognise his own mortality because his wife has threatened to kill him more than once.

He’s never smoked a cigarette – unless you count that one sneaky drag he had back in 1993 when he tried to fit into the cool gang at college.

He failed horribly.

Anyway, Pat is looking for a life insurance policy of €500,000. Factoring in possible funeral costs, mortgage payments and regular life bills his family may face if he was to meet his maker sooner rather than later, he’s gone for a comfortable half a milly.

But, let’s face it, Patrick isn’t a spring chicken, so instead of a more comfortable 30 years premium payment schedule, he’s settled for 20 years, just to be on the safe side.

With just this small amount of information – it looks as though Patrick’s estimated monthly premium clocks in at:

€66 per month.

Are you surprised?

Were you expecting it to be more expensive? If you were happy days, you could afford a good level of cover.

If that seems too dear, well, you simply reduce the cover to a more manageable level because some life insurance is better than none.

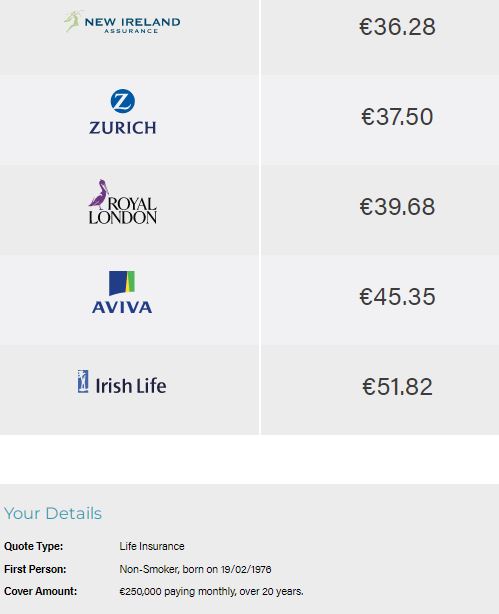

Let’s say Patrick wants to spend €30; let’s halve the cover to €250,000 – how much?

Ta-dah!

€36 per month.

Patrick can continue to play this game until he hits the Goldilocks premiums – just right.

So you see, life insurance can’t be too expensive – it all depends on how much you are willing to pay.

Thank you, Patrick; you may return to your seat.

What makes Life Insurance more expensive?

Patrick’s quote is based on the assumption that everything else to do with his health and lifestyle is in tip-top condition. That even his family health history is like a shiny new penny.

Unblemished.

But, let’s be honest, life isn’t as clear-cut as that. Patrick may find that his premium costs more than the initial quote that pops up on the web.

e.g. If Patrick’s BMI is over 33, he will pay more. The heavier you are, the more of a risk these life insurance boys will view you as. On the flip side, if your BMI is under 18, you’ll probably pay more too. Insurance underwriters don’t like extremes.

Look at it this way, it’s warped but true:

You are putting down money (let’s call it betting) that you will die within the term of your policy. The insurer is betting that you will survive, so they don’t want to risk you popping your clogs before your policy ends. They ask a series of questions (underwriting) before taking on that bet to ensure the odds are stacked in their favour.

What else do I need to know to keep my life insurance premiums low?

Being a smoker will also increase those premium quotes.

I mean, most of you already know this, but did you know that even if you have given up smoking unless it has been over 12 months since you have puffed your last puff/vaped your last vape, your insurance provider still classes you as a smoker?

Age is a biggie!

The younger you are when you sign up for your life insurance policy, the cheaper it will be.

Even better, your life insurance premium is fixed for the term of your policy.

So those with the forethought to sign up for a life insurance policy when they are 30 will enjoy the privilege of still paying a thirty-year-old’s premium when they are 70.

So, how much should you spend on life insurance?

Let’s play a game.

The average cost of pet insurance is €16 per month.

House insurance is €41 per month on average.

And to insure your car costs €56 per month.

How much is your life worth compared to your dog, gaff and motor?

Over to you…

If you’re serious about finding out how much you may need to spend on your life insurance, well, that’s what my expert team and I are here for.

We’ve been doing this lark for donkeys, so we know the score.

So, what now?

Complete this financial questionnaire, and I’ll be right back.

I’m quicker on the draw than ole Doc Holliday when replying to your emails, so you won’t be waiting long.

Or you can DIY and go to my online quote calculator here or request a callback if you have questions.

Thanks for reading

Nick