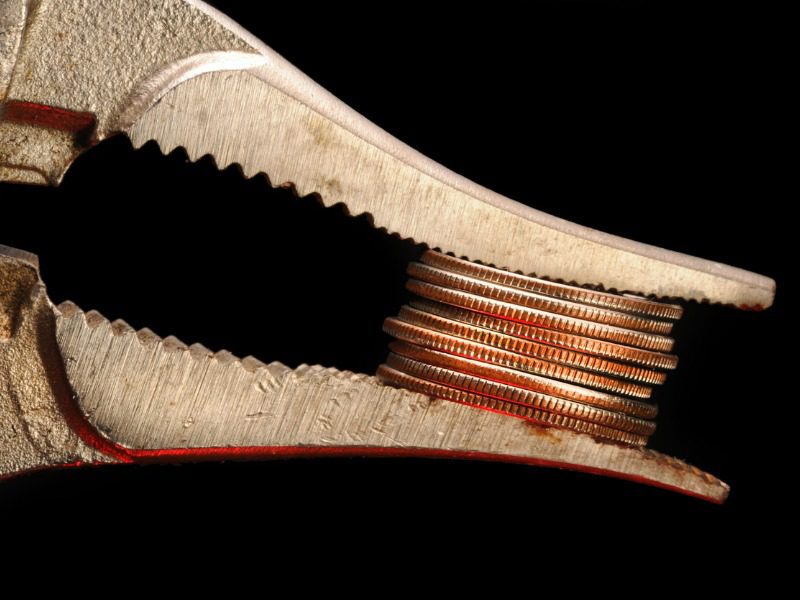

Will inflation reboot the P&C hard market?

Although the commercial insurance market shows signs of gradually shifting toward more stable conditions, the hard market isn’t yet in the rear-view mirror and a soft market hasn’t arrived.

“I would say we are more in a transitioning market [and] that rigorous underwriting discipline is unlikely to lessen anytime soon,” said Celyeste Power, executive vice president of strategic initiatives and advocacy at the Insurance Bureau of Canada. “As the industry turns to growth, emerging issues like inflation, supply chain disruptions [and] cyber risks [that] increased significantly over the pandemic, and then the increased catastrophic weather events, will keep insurers quite focused on risk quality.”

Meanwhile, she noted, inflation is impacting all P&C industry sectors by pushing up claims costs, property prices, and labour costs to repair and restore those properties.

“We’re seeing it specifically in the commercial sector. While insurance premiums are stabilizing from the hard market, the value of the properties is increasing,” she told Canadian Underwriter. “And we’re seeing an inflationary factor on the labor force as well [which] is why I think we’re in more of a transitioning market versus all the way back to the soft market.”

During 2022 Q2, Allianz Global Corporate & Specialty saw the impact of inflation on commercial building reconstruction and restoration approach a 15% increase over the same period in 2021, said chief agent Bernard McNulty.

“We underwrite a limited number of frame residential projects in Canada, but the increased costs of construction for those is over 20%,” he told CU. “Our clients are advising us that the costs of materials such as steel and lumber have been rising steadily since last fall. [They’re] pre-ordering material and strategically bulk buying more than ever.”

Plus, he said, current fiscal policy efforts to control inflation through interest-rate hikes might prove to be a double-edged sword.

“In the short term, added borrowing costs have an inflationary impact to construction and increases the costs of materials,” said McNulty. “In the longer term, contractors have to charge more, and this will eventually cool demand for projects.”

As the hard market eases, Power doesn’t foresee improvements in the cyber market, following increased claims during the pandemic. Transportation also has been a challenging line of business, she noted, even prior to the hard commercial market.

“We have to work very closely with the commercial transportation industry to make improvements to that business line,” Power said. “I think there will be challenged markets coming out of the hard market and inflation is only exacerbating that scenario.”

Feature image by iStock.com/mj0007