Rhine river level falls in heatwave, bringing parametric triggers into focus

Water levels in Germany’s river Rhine have dropped to levels that are now concerning shipping and transport companies, as well as those looking to trade and receive goods using the waterway, with levels forecast to decline close to where we understand parametric triggers for insurance have been set.

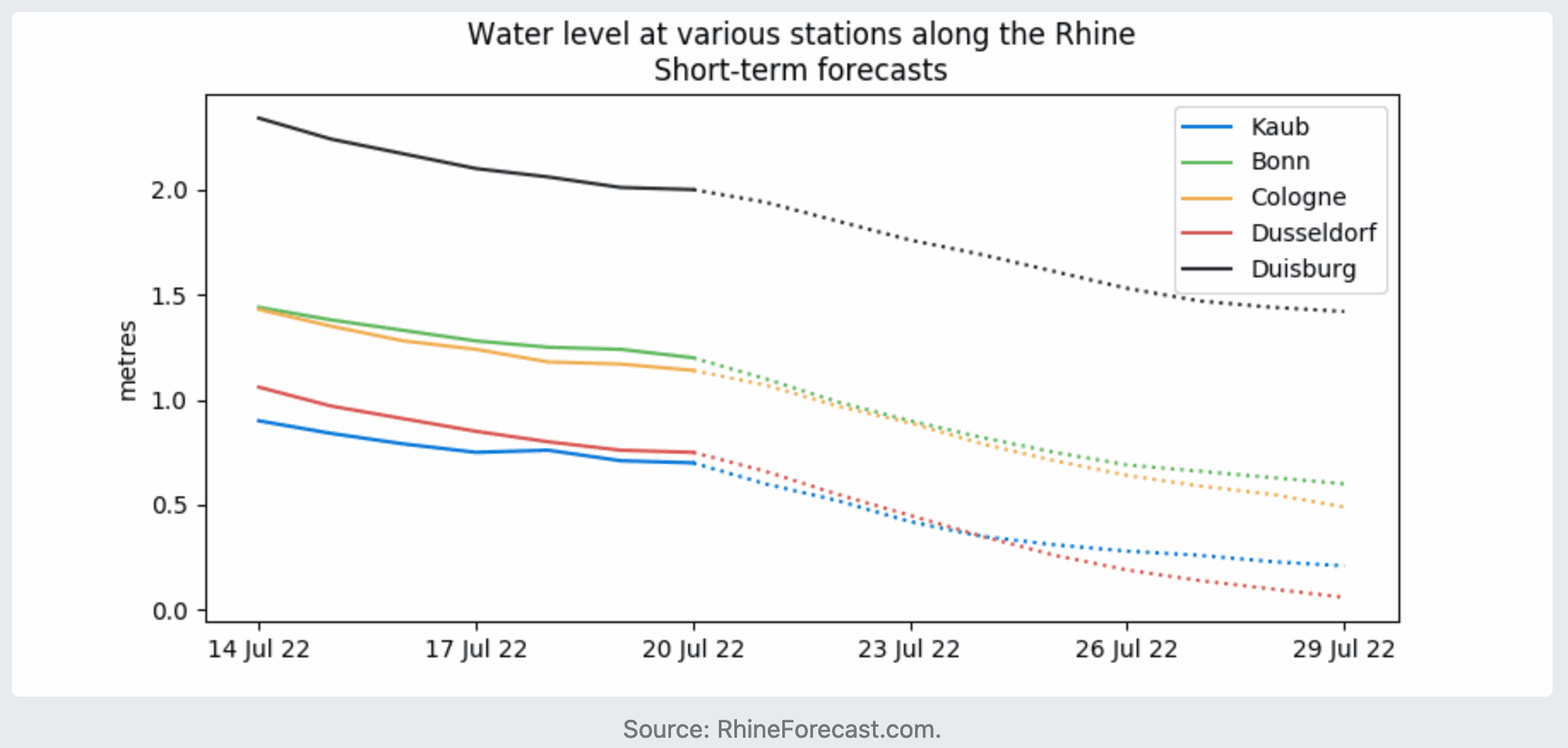

As of this morning, Thursday July 21st, the water level at the Kaub bottleneck, a notorious and more shallow point along the Rhine and which is typically quickest to become impassable, are reported at 71 centimetres, having fallen to just 68 centimetres late yesterday.

This is said to be the lowest water level at this bottleneck since at least 2007, according to German government data and even now this is having a costly impact to shipping on the river Rhine.

Water levels in the Rhine are currently forecast to drop much further:

Low water levels mean ships cannot travel as heavily laden as they would, raising costs and according to a recent Bloomberg report should the level get to 40 centimetres it would be considered uneconomical for commodities or any heavy good to be transported by river.

A significant percentage of Germany’s shipped cargo navigates the Rhine at some stage in its journey, meaning a very low river level can put very high trade values-at-risk.

Low water levels have significant ramifications for shipping and the supply of goods, with companies likely to pay more for alternative methods of transportation.

In addition, when the river levels are lower the costs to ship increase and in the case of the Rhine in Germany there are additional levies to pay for cargo to be carried when water levels drop below a certain level, or multiple vessels may be used to lighten loads and allow ships to traverse shallower waters.

As a result, companies seeking to ship their goods, or expecting delivery of goods, by water on the Rhine, can face higher expenses and costs when the river level falls.

Which is a non-damage business interruption risk, driven by climate and the environment, one of those that parametric insurance can often be so effective at covering.

Of course, very low river levels due to prolonged drought, or heat spells, can also drive insurable losses to property, as well as through supply chain risk.

In those cases traditional insurance covers may not provide as much compensation as risk managers would like to receive, making a supplementary parametric cover based on publicly available river gauge data an effective complementary risk transfer tool.

It’s worth considering the economic ramifications of a slowdown in Rhine river traffic and trade, as this can cause inflationary effects on goods from building materials to energy.

A previous period where the Rhine became less easy to navigate due to low water levels was said to have caused a 0.5% hit to German GDP.

In the current inflationary environment and with Europe’s energy challenges, it could make non-damage business interruption coverage even more important for companies across the region this year.

In the past, low water levels in the Rhine have even been attributed as almost the cause of recession, with low river levels in 2018 said to have driven negative and recessionary effects through the German economy in 2019.

It’s also been said that low Rhine water levels are a cause of supply-chain interruption to the entire German manufacturing sector, given how important river trade is to the country.

Hence the insurance and reinsurance industry has developed parametric insurance and risk transfer products based on the level of waters in the Rhine.

We understand that among those selling such products to clients, have been brokers Guy Carpenter and Aon, as well as markets including global reinsurance firm Swiss Re’ Corporate Solutions and AXA Climate, the parametric specialist unit of the global insurer.

We’re certain other parametric specialists will also be selling parametric risk transfer as a non-damage business interruption cover against water levels dropping in the most important navigable waterways in the world, as well.

Right now we’re told the river needs to drop further for any triggers to be breached, but with Germany having suffered a heatwave in recent days and the river level forecast to drop further, this could become a risk considered on-watch for those with capital deployed and at-risk.

Finally, the way water levels hinder trade along the river Rhine also has broader ramifications in insurance and reinsurance, with the potential for supply chain interruption and as a result business policies could also see some claims if the water levels continue to decline.