Munnell Doubts the Typical U.S. Retirement Age Will Keep Rising

The authors of government reports often cite her research, and Congress often brings her in to hearings, to talk them through retirement policy issues.

The Brief

Munnell writes in her briefs that Social Security and Medicare helped push the average U.S. retirement age lower in the middle of the 20th century.

In recent years, she says, changes in Social Security rules have helped push up the typical retirement age.

Other forces increasing the average retirement age have been the shift away from defined benefit pension plans, which has eliminated built-in financial incentives for people to retire relatively early; increases in typical education levels; the decline in access to employer-sponsored retiree health benefits; and improvements in older Americans’ health.

Munnell argues that many of those trends have flattened out, or started going in a different direction.

In the area of healthy life expectancy, for example, progress seems to have stalled, Munnell writes.

“While the percentage of men and women with a work-limiting disability declined between 1980 and 2005, the percentages held relatively steady between 2006 and 2018,” she says. “Moreover, estimates of health life expectancy at 50 — which combines the disability rate with changes in life expectancy — showed actual declines for lower-educated white workers and lower-educated Black men. Hence, substantial increases in the ability to work longer is unlikely to move the average retirement age in coming decade.”

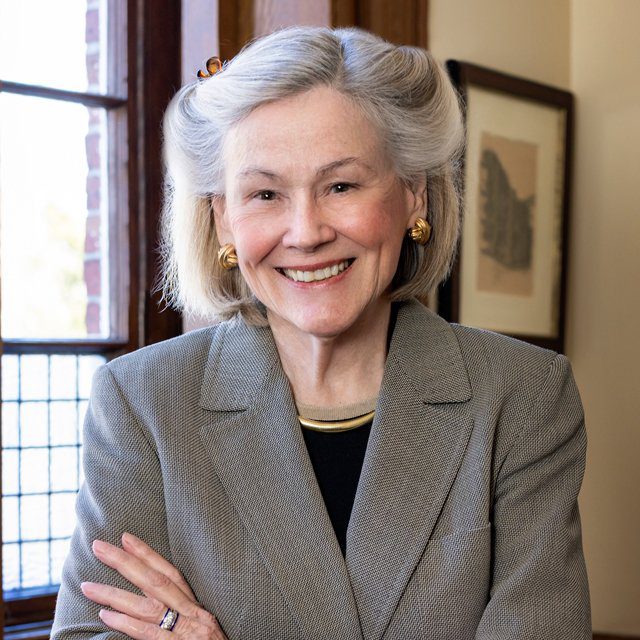

Pictured: Alicia Munnell, director of Boston College’s Center for Retirement Research.