Electric-Car Companies Are Less Responsive to Customer Questions: Survey

These are challenging times for customers looking to buy any kind of vehicle but, a newly released study shows, particularly difficult if you’re shopping with an EV startup.The Pied Piper research firm studied customers of 25 premium auto brands, using “mystery shoppers” to evaluate the shopping experience, checking things such as response to website inquiries and the quality of the in-person shopping experience.The resulting Prospect Satisfaction Index found Lucid, Polestar, Rivian, and Tesla were less responsive to shoppers than established brands such as Cadillac and Infiniti, even though EV customers may need more questions answered than people shopping for traditional gas-powered vehicles.

Electric-vehicle advocates and early adopters have long maintained the experience of learning about EVs, shopping for them, and buying them is better at those few brands that sell directly to buyers—Tesla foremost, now also Lucid and Rivian—than at conventional third-party franchised dealers of the sort used by Toyota, GM, Honda, Ford, and other established carmakers.

Now a study from the research firm Pied Piper appears to turn that conventional wisdom on its head. Conducted from July 2021 to June 2022, it compared the helpfulness and responsiveness of sales staff from established brands against those at independent locations operated by EV startups. Covering 25 premium brands, it spanned more than 1000 measurements of the in-person sales experience and 1650 measurements of responsiveness to customer inquiries on the company’s website. The five top-ranked brands were Cadillac, Infiniti, Mercedes-Benz, Acura, and Volvo, while four of the five lowest scorers were EV companies: Tesla, Lucid, Polestar, and Rivian.

Pied Piper Industry Studies

The Prospect Satisfaction Index (PSI) study has been issued annually since 2007. It uses mystery shoppers who rate locations against “customer helpfulness and sales best practices,” which, the company notes, “measure and report how effectively retailers help their shoppers become buyers.”

Pied Piper Industry Studies

The audience for the study is both carmakers and national dealer groups, but Pied Piper funds the study itself. “Our business is helping [automakers] improve their sales,” CEO Fran O’Hagan told Car and Driver, “by calculating sales best practices and then measuring and reporting dealer by dealer whether those best practices are followed.”

Owners and advocates note, correctly, that the process of deciding to buy an electric car involves more research and education than replacing a five-year-old compact crossover with a new compact crossover. Questions on how EVs are charged and what their real-world range may be under a variety of use cases, plus concerns over battery life, are among the most common queries.

For that reason, this study can be viewed as handicapping EV-only makers, since a majority of their buyers will be new to EVs and require more time and more handholding. A first-time buyer may require more visits to the Chevrolet dealer to choose a Bolt EV over a Trax, but that extra time is rolled into the far larger pool of more conventional sales of vehicles without plugs—which require none of that education.

For the first time, this year’s survey included seven exotic brands, including Ferrari and Rolls-Royce, and three new EV brands (Lucid, Polestar, and Rivian) along with Tesla. The exotics’ scores were variable at best: high on some measures, low on others. But the EV-only brands as a group scored lower on responsiveness and steps toward closing a sale, and Tesla’s ratings slid.

Wakeup Call for Startups

Still, many of the study’s findings suggest EV-only makers simply aren’t as responsive to inquiries as dealerships. For instance, more than 50 percent of the time, the best of the 25 premium brands responded to customer web inquiries in 30 minutes or less. Polestar, Rivian, and Tesla (as well as Ferrari) did so less than 10 percent of the time. EV brands also scored lower on use of texts, phone calls, and immediate responses to shoppers’ use of website chat features.

As for visits to the brands’ locations—the study calls them “dealerships” throughout—there too EV brands suffered against the standardized processes of third-party franchised dealerships for established makers. (Because Rivian has no retail outlets, the study notes its in-person measurement was “carried out instead by customers contacting the brand by phone call, to give the brand an opportunity to interact in a [similar] manner.”)

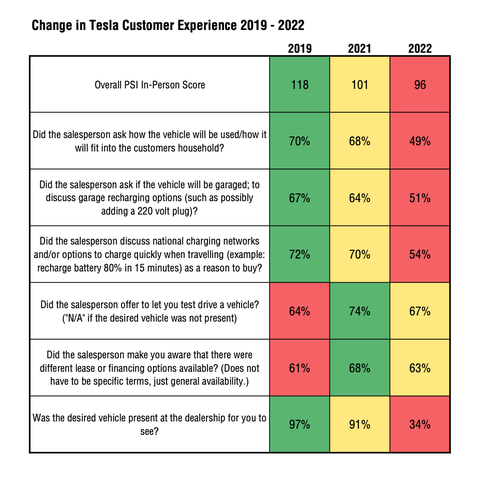

Tesla, the highest-volume EV maker, had rated above average or leading in earlier Pied Piper studies in 2019, 2021, and 2022. But its ratings have now slipped below the average. Tesla’s “sales methodology has transformed more into order-taking than customer assistance,” the company concludes. “Tesla’s model today appears to be, ‘If you want what we sell, and require no assistance, it’s easy to order,’ ” commented O’Hagan.

“With an online focus and few retail locations, these new EV brands have a great opportunity to excel with phone, chat, and email interactions with their customers,” O’Hagan said. “However, we found that when their customers reach out for help or with questions, they are usually met with brand reps who answer only simple, scripted questions without being proactively helpful.” He called it a “missed opportunity” to turn inquiries into potential customers.

This content is imported from {embed-name}. You may be able to find the same content in another format, or you may be able to find more information, at their web site.

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io