BofA Survey Shows Full Investor Capitulation Amid Pessimism

What You Need to Know

Investor allocation to stocks plunged to levels last seen in October 2008 while exposure to cash surged to the highest since 2001.

Investors slashed their exposure to risk assets to levels not seen even during the global financial crisis in a sign of full capitulation amid a “dire” economic outlook, according to Bank of America Corp.’s monthly fund manager survey.

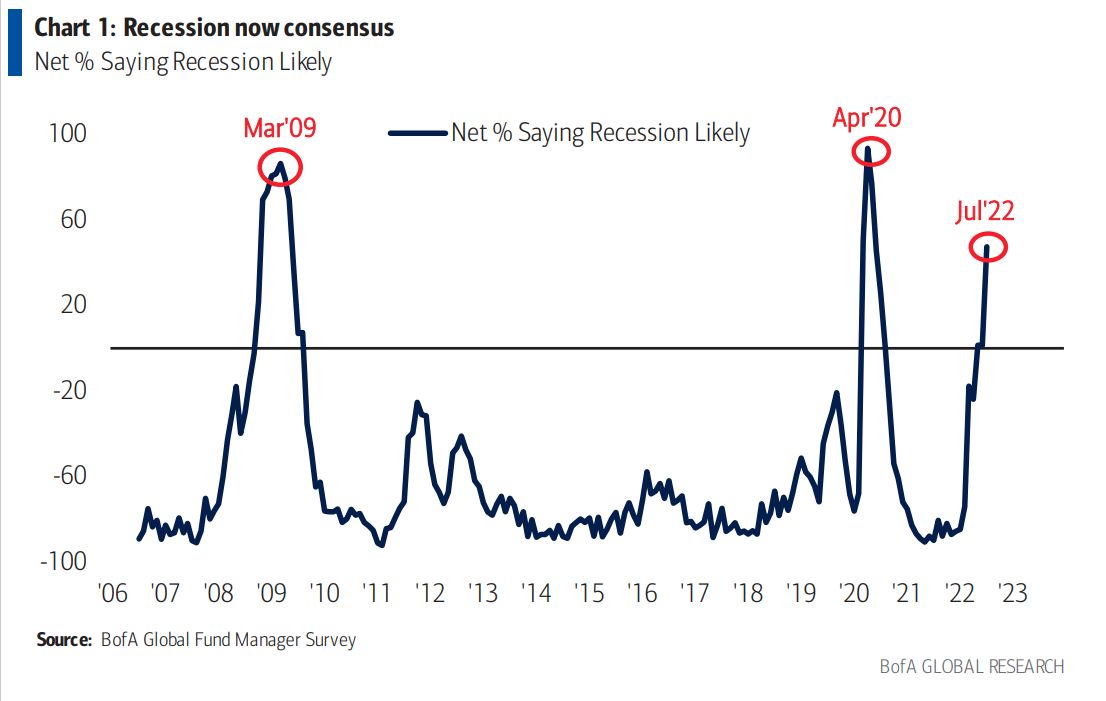

Global growth and profit expectations sank to an all-time low, while recession expectations were at their highest since the pandemic-fueled slowdown in May 2020, strategists led by Michael Hartnett wrote in the note.

Investor allocation to stocks plunged to levels last seen in October 2008 while exposure to cash surged to the highest since 2001, according to the survey. A net 58% of fund managers said they’re taking lower than normal risks, a record that surpassed the survey’s global financial crisis levels.

Bank of America’s survey, which included 259 participants with $722 billion under management in the week through July 15, said high inflation is now seen as the biggest tail risk, followed by a global recession, hawkish central banks and systemic credit events.

At the same time, the most investors since the global financial crisis are betting that inflation will be lower in the next year, which means lower interest rates, according to the poll.

The survey’s findings highlight this year’s flight from risk assets, which has sent the S&P 500 Index into a bear market and led European stocks to their worst six-month drop since 2008.

Although optimism is brewing again that US inflation could be nearing a peak, sentiment remains subdued with risks around a potential economic contraction remaining high. A looming energy crisis in Europe has also added to the uncertainty.

Bank of America strategists said their custom bull & bear indicator remains “max bearish,” which could be a contrarian signal for a short-term rally.