Billionaires Can't Get Enough of Private Equity

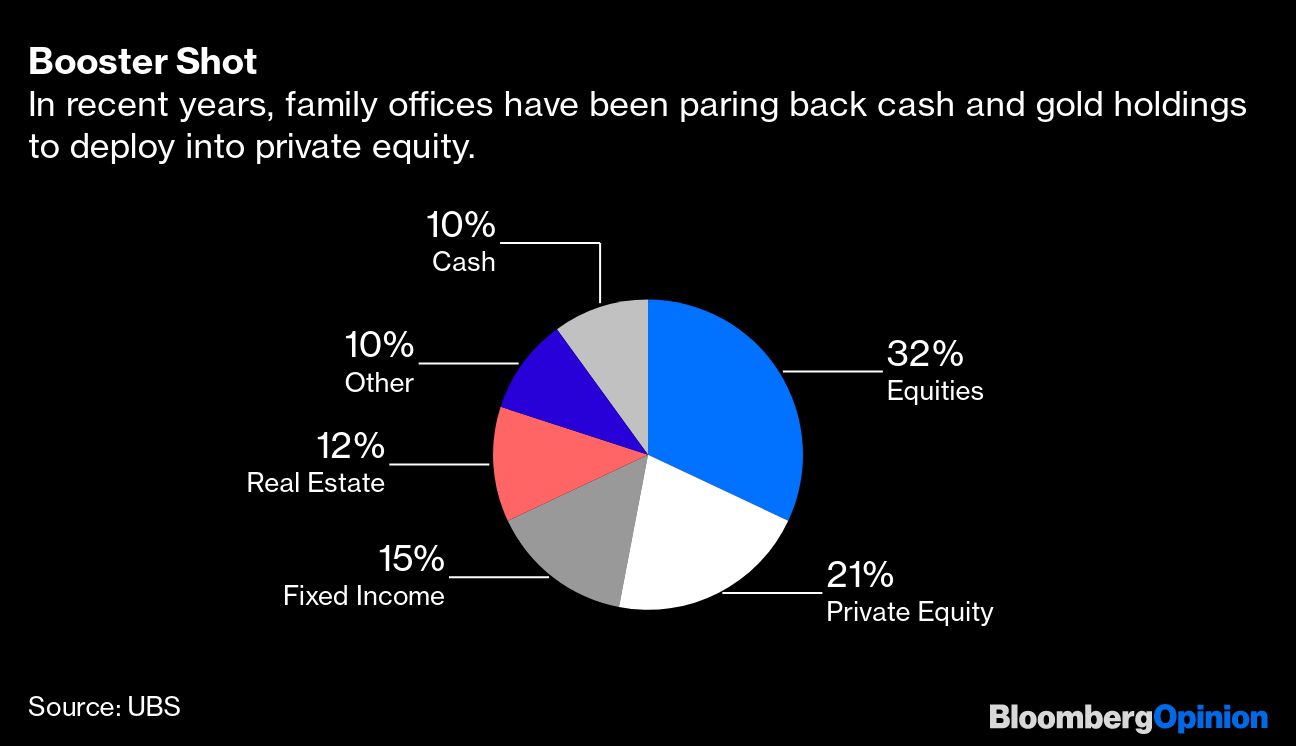

As of 2021, these billionaire offices were already allocating 21% of their money into PE, either via direct investments or through funds. And yet they overwhelmingly plan to keep raising their stakes as they extend their retreat from boring old cash and bonds.

Of course, valuation is a concern. PE firms in recent years paid handsomely for their investments.

In the first quarter, a median buyout was priced at 14.6 times EV/EBITDA — or the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization — versus 11.9 times four years earlier, according to PitchBook. By comparison, the S&P 500’s valuation multiple has fallen to just 12.8.

But the wealthy seem undeterred. Of those surveyed by UBS, 85% said they’re likely to invest early-stage companies this year, up from 74% in 2021. This is right in Tiger and Coatue’s new wheelhouse.

Tiger’s latest venture fund focuses more on companies in their early stages anyhow, while Coatue reduced late-stage deals this year as well.

By now, private equity has become billionaire families’ favorite, with about 75% believing that this asset class will continue to outperform public markets.

But, alas, the one category of investors that have been kept out of this are retail investors. So the rich will just get richer, while everyone else looking for the big score gets stuck chasing meme stocks and crypto tokens.

***

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. A former investment banker, she was a markets reporter for Barron’s. She is a CFA charterholder.

(Image: Adobe Stock)