UCITS catastrophe bond funds see sluggish growth through H1

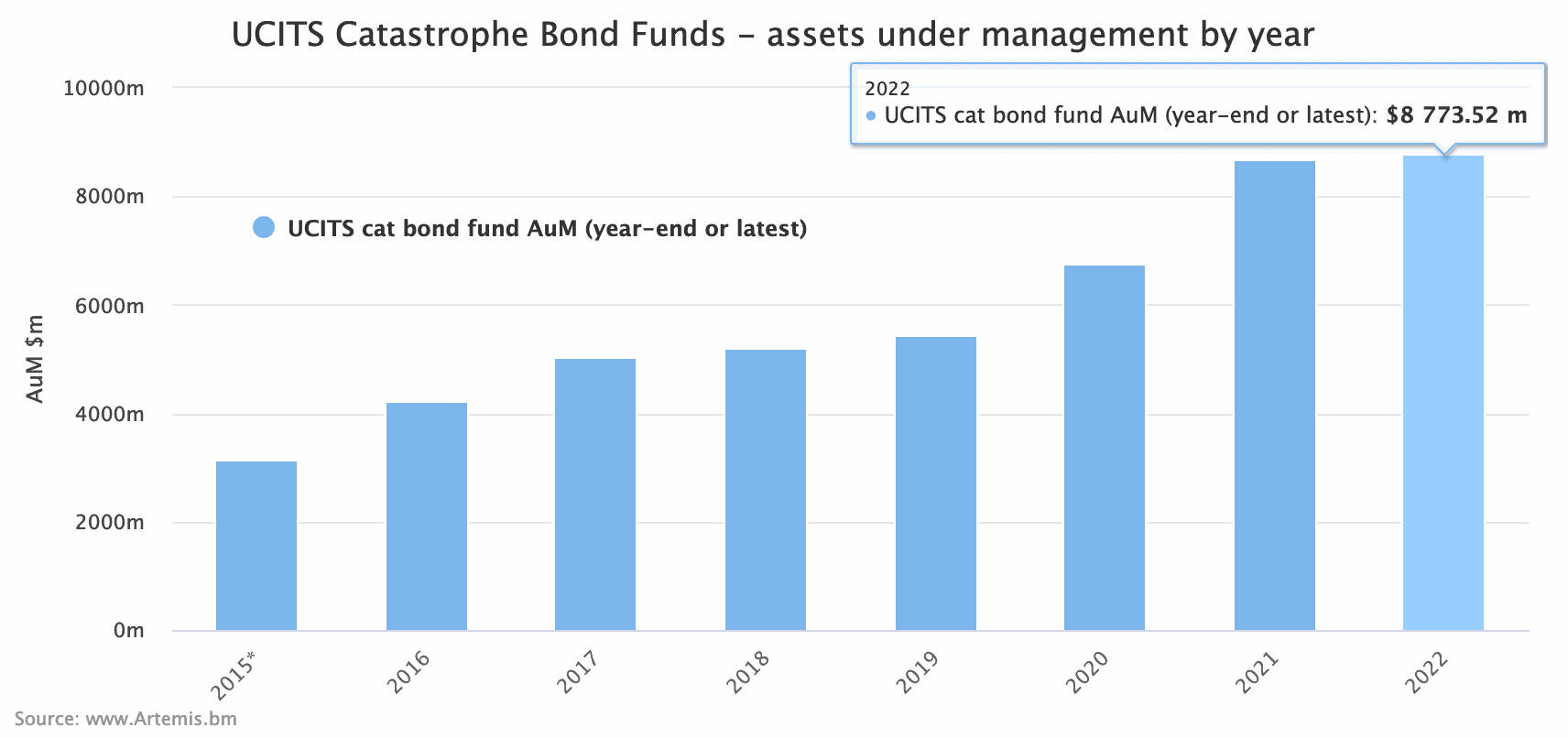

The assets under management (AUM) of the main UCITS catastrophe bond funds as a group only rose by 1.2% through the first-half of 2022, which goes some way to explain the restricted capacity of recent months.

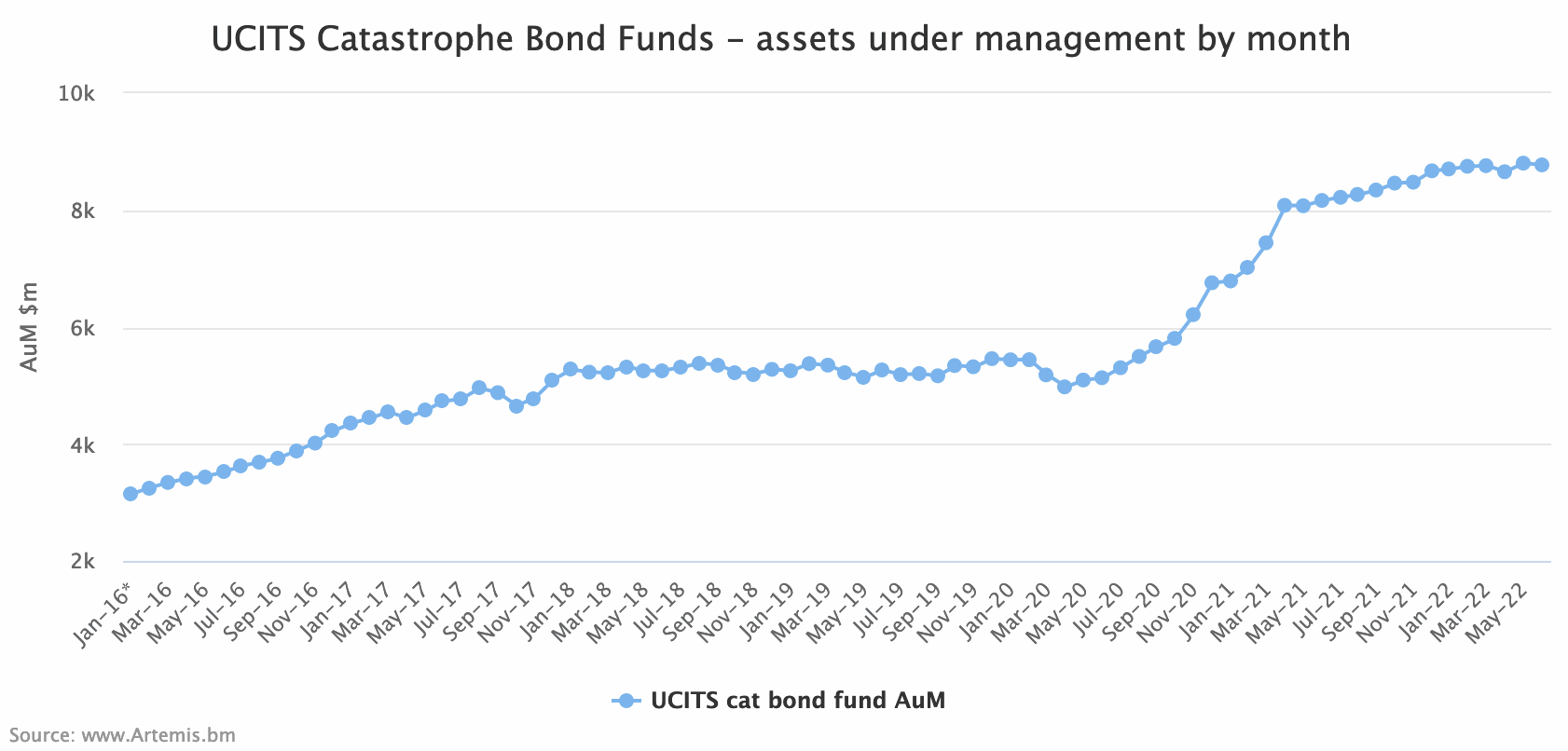

Having expanded rapidly from AUM of just under $5 billion at the end of April 2020, to more than $8 billion by the end of April 2021, growth of the UCITS cat bond fund class of insurance-linked securities (ILS) fund structures was the steadier through the end of last year and much slower through 2022 so far.

That was a massive 62% growth in AUM for the UCITS cat bond funds as a group over that 12 month period from the end of April 2021.

Through the rest of last year the growth in UCITS cat bond fund AUM slowed to 7% over the 9-month period.

So the slowdown is clear, as UCITS cat bond fund AUM only rose by 1.2% through the first-half of 2022, to reach over $8.77 billion at the end of June, according to Artemis’ data.

We track UCITS cat bond fund assets here in this chart with the help of partner Plenum Investments AG, a specialist insurance-linked securities (ILS) and cat bond investment manager.

Growth in UCITS cat bond fund assets was around 28% in 2021, but in the first-quarter of 2022 that slowed to only around 1.1% in the first-quarter, to reach just under $8.72 billion by the end of March 2022.

Despite the strong period of catastrophe bond issuance in the second-quarter of the year, assets across the UCITS cat bond fund category only rose another 1.2%.

The slow growth in catastrophe bond fund assets at these major contributors to the market aligns with recent cat bond market dynamics, where a lack of fresh inflows has been one of the factors exacerbating recent spread widening.

Analyse UCITS catastrophe bond fund asset growth using our charts here.

As we’d explained, many of the largest catastrophe bond funds had seen their managers raising new capital in 2021, much of which additional capacity had been fully-deployed by the time the cat bond issuance pipeline exploded into life this year.

This is clearly evident in the strong build-up in assets at these leading UCITS catastrophe bond funds through last year, as well as the more recent slowing, in Artemis’ chart below.

Even more interesting is the fact there was a slight dip in assets during the second-quarter and there are some outflows evident at some UCITS cat bond fund managers.

As we reported earlier this week, there have been some outflows in ILS funds generally around the mid-year point and it seems these extended to some cat bond fund strategies as well.

As ever though, it’s not completely clear how managers are being affected by changes in their UCITS cat bond fund AUM’s, as we understand some have seen investors transition into other strategies in advance of the mid-year, either closed-ended cat bond funds or funds with a broader ILS instrument mandate.

In terms of the major UCITS cat bond funds, the strongest growth in the first-half can be seen at Twelve Capital’s strategy, the Twelve Cat Bond Fund, which has grown almost 15% over 2022 so far to over $1.9 billion.

The Fermat Capital managed GAM Star Cat Bond Fund remains the largest UCITS cat bond strategy, at over $2.6 billion in assets, having added 5% over the first-half.

The Schroder GAIA Cat Bond Fund conversely lost 5% this year, but still counts almost $2.3 billion in cat bond assets in the strategy.

Over the first-half of 2022, the Plenum Investments Cat Bond Dynamic Fund reported the fastest growth of 63%, while the Tenax ILS UCITS Fund, managed by London based hedge fund manager Tenax Capital, grew second fastest in percentage terms, adding 59%.

So, clearly these UCITS cat bond funds almost all bulked up their assets through late 2020 and early 2021, resulting in a glut of capacity that drove some cat bond rate softening last year.

But now that glut of excess cat bond fund capacity has been soaked up and deployed, while inflows have been more measured of late, the way UCITS assets have stabilised over the first-half, while issuance continued to outpace maturities, goes a long way towards explaining the spread effects seen in the cat bond marketplace.

Looking ahead, with the pipeline expected to remain busy for new cat bonds later this year, there should be opportunities for the UCITS cat bond fund managers to deploy more assets and so we could see inflows pick-up in the second-half of 2022.

Analyse UCITS catastrophe bond fund asset growth using our charts here.