Aon reveals "near-perfect storm" hitting reinsurance buyers

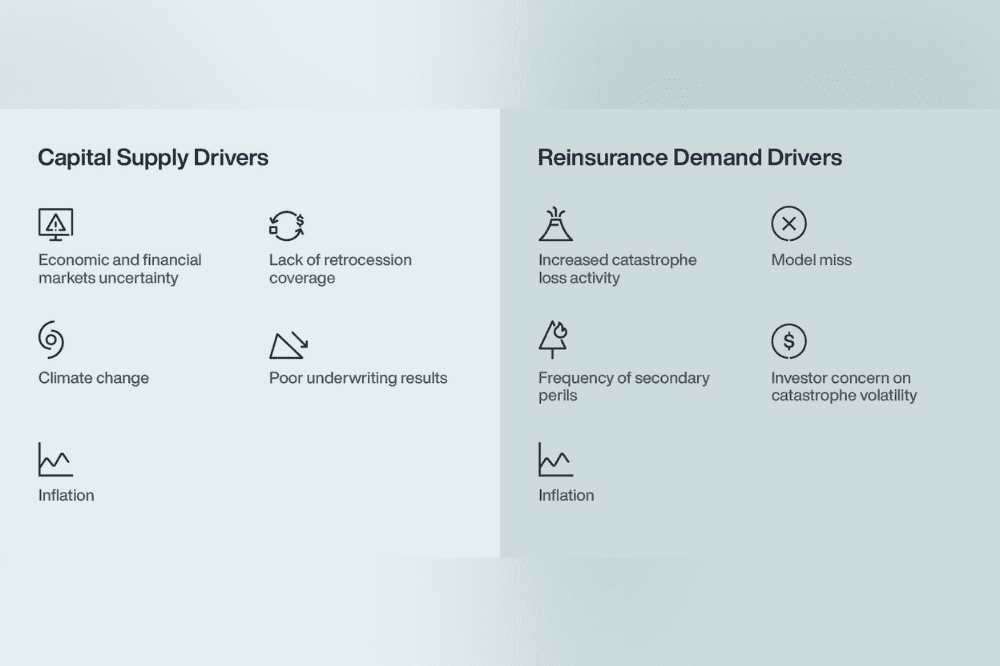

Aon found that reinsurer capital decreased to US$645 billion as of March 31 from the US$675bn recorded at the end of 2021, which it attributed to unrealized losses on bonds, in turn, linked to rising interest rates. Within the US$645 billion figure, however, alternative capital increased to US$97 billion, showing investors’ increased appreciation of the need to diversify while buffing margins amid turbulent financial markets.

After years of higher-than-average catastrophe claims, reinsurers have finally reduced their appetite for catastrophe exposure. For the first time since the 2004 and 2005 hurricanes – including Charley, Ivan, and Katrina – property natural catastrophe capacity has contracted materially.

Specialty also faced its most challenging renewal in years, reflecting the potential for large

losses from the war in Ukraine. In contrast, the casualty reinsurance market remained stable despite concerns about social inflation and emerging risks.

Looking ahead, Aon foresaw the property reinsurance market approaching a true ‘hard’

market, where overall demand is not readily satisfied and the uncertainties in the market put insurer capital under pressure just as reinsurers retrench. Attracting new sources of capital to the market, along with data-led portfolio differentiation, will be essential to meeting insurers’ reinsurance needs going forward, Aon concluded.