Pregnancy Costs – HELP please parse out all of this information (plan summary in google doc)

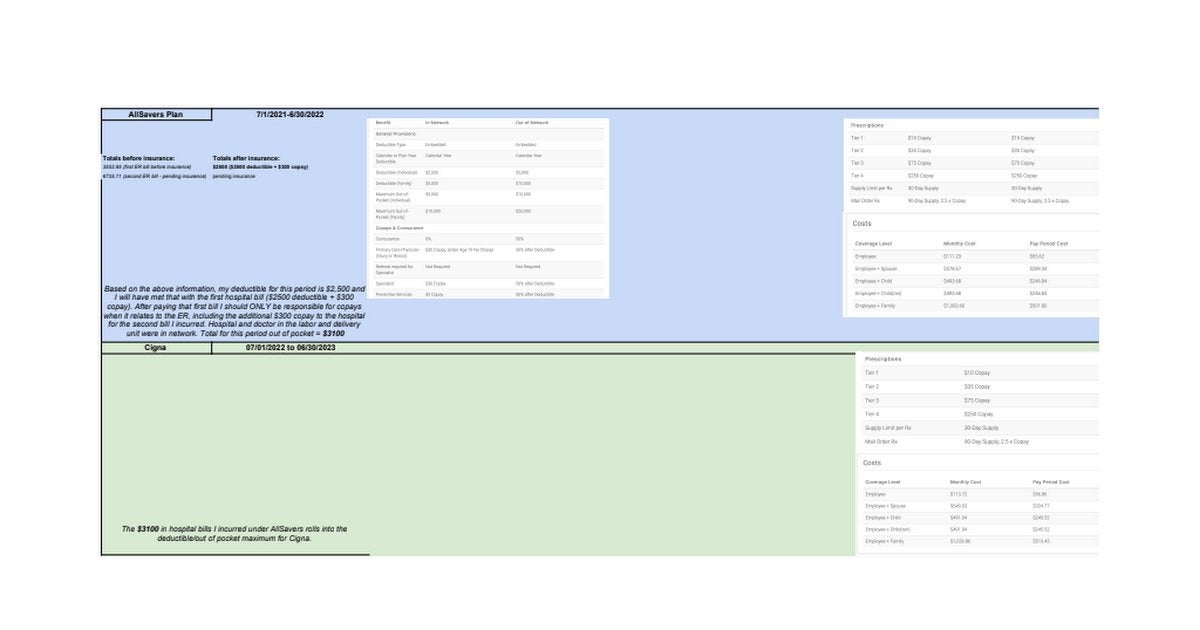

Hello everyone! I’ve had a difficult pregnancy with two ER visits thus far and I am due in 3 months. I am having a hard time going through all of the insurance mumbo jumbo and I believe the question I have if answered will tell me if I should expect a $5,000 bill or a $10,000 bill after I deliver the baby. My main confusion is centered around the deductible and out of pocket maximum. To add to the mess, my health insurance carrier is switching in a few days from AllSavers –> Cigna. All doctors and the hospital are in network. My OBGYN is connected to the hospital and the doctors from my OBGYN work/switch off as the labor and delivery doctors. I’m located in Hawaii, but everyone else from my work is in Texas so I’ve had to spend double duty time making sure everything is in network (with the old insurance carrier and the new carrier) to ensure everything will be “covered”.

A few things:

– I’ll be adding the baby to my insurance plan within 30 days of delivery

– After talking to the hospital, they said they do bill the infant separately after the baby is out for any services they incur.

– The plans deductibles + out of pocket maximums are calendar year, and the previous plans paid deductible/out of pocket maximums will contribute towards the new plan deductible/out of pocket maximum.

I’ve laid out the plan summaries and bill amounts in this google sheet (anyone with the link can view – no private info showing):

https://docs.google.com/spreadsheets/d/1cFyvW6jkClf-hkZT_TLPOfJWz7k6rIpesy_EDzKCsWc/edit?usp=sharing

With the individual plan I currently have (ending in a couple days) there’s a $2500 deductible. I am signed up for an individual plan for the new carrier, but I’m assuming once I add the baby to the plan (within 30 days) the hospital bills incurred for the baby will go towards the family deductible (driving us up to the $5000 deductible).

I’m just confused as to when/how the $10,000 out of pocket maximum will be “triggered,” and if its possible for that to happen with the labor and delivery costs to balloon up to the $10,000. I understand if I accidentally went out of network to a doctor or had another ER visit later this year, that those out of network bills/ER visit copays would go towards the $10,000 out of pocket maximum. I’m just trying to figure out if I’ll pay maximum $5000 for this birth, or if its more likely for it to be up to $10,000 and trigger the out of pocket maximum somehow.

Hoping for good news, but in all events I would like to be as prepared as possible! Thank you SO much to anyone who takes the time to read this and help me parse out this information. With maternity leave my pay is going to decrease drastically (over half of my income is commission and will be reassigned to another team member) and I’m already making way less than last year in general.