Derecho Storm Ranks 6th Largest Insured Loss Event in Canadian History

More than $875 million in insured damage across Ontario and Quebec

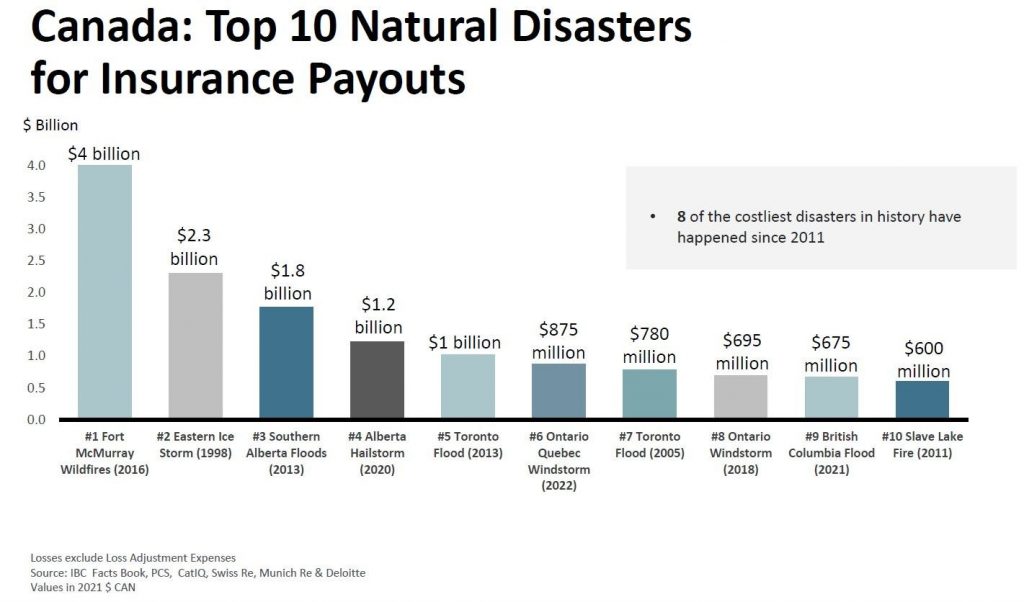

Toronto, ON (June 15, 2022) – The destructive and deadly storm that swept through southern Ontario and parts of Quebec on Saturday, May 21, caused over $875 million in insured damage, according to initial estimates from Catastrophe Indices and Quantification Inc. (CatIQ). Damage in Ontario is estimated to be over $720 million, while the storm caused an estimated $155 million of damage in Quebec. This storm now ranks as the sixth largest in Canadian history in terms of insured losses – surpassing the Toronto flood of 2005. The derecho caused widespread damage to property, extensive power outages and sadly, loss of life.

“As we begin to contemplate the enormity of the financial losses, we must pause for a moment in the face of the loss of life,” said Kim Donaldson, Vice-President, Ontario, Insurance Bureau of Canada (IBC). “This was largely an insurable event and insurers have been on the ground since Day 1, working hard to help their customers throughout the entire claims process. And, insurers will be there until all claims from their policyholders have been processed. Those with general insurance questions are encouraged to contact IBC’s Consumer Information Centre at 1-844-2ask-IBC.”

The powerful storm, described as a derecho, was far-reaching and impacted a densely populated corridor across southern Ontario and into Quebec. Close to 30,000 homes in Ontario and Quebec were without power for more than a week after the storm. Although hail and torrential rain accompanied the storm, wind caused most of the property damage.

The derecho event ranks as the sixth largest in terms of insured losses in Canadian history and is a sobering reminder of the increasing risk climate change poses to communities across Canada. IBC continues to advocate for a National Adaptation Strategy that will result in tangible short-term measures that improve Canada’s climate defence. Governments at all levels must act with urgency to prioritize investments that reduce the impact of these severe weather events on families and communities.

Damage caused by wind is typically covered by home, commercial property and comprehensive auto insurance policies. IBC reminds residents that the insurance industry is committed to assisting its customers throughout the entire claims process for this and any other severe weather event.

IBC launched its virtual Community Assistance Mobile Pavilion (CAMP) immediately following the May 21 storm to assist impacted residents with their insurance questions. In southern Ontario, where the damage was most extensive, IBC was on the ground in Ottawa with CAMP shortly thereafter. CAMP is still operating virtually and consumers with insurance questions are encouraged to contact IBC at 1-844-2ask-IBC (1-844-227-5422) or [email protected]. For more insurance information related to this storm and severe weather in general, please visit www.ibc.ca/on/disaster/wind.

More can be done to prevent damage and injuries from severe wind events through low-cost and effective changes to national and provincial building codes. Canada must develop a comprehensive plan to close governance gaps and improve climate defence overall. This also includes investments in new infrastructure to lessen the impact of floods and fires on communities, better land-use planning and, increasingly, the creation of incentives to shift the development of homes and businesses away from areas of highest risk. IBC is committed to working closely with the private sector, first responders and governments to improve Canada’s preparedness for and resilience to severe weather events.

The amount of insured damage is an estimate provided by CatIQ (www.catiq.com) under licence to IBC.

About Insurance Bureau of Canada

Insurance Bureau of Canada (IBC) is the national industry association representing Canada’s private home, auto and business insurers. Its member companies make up 90% of the property and casualty (P&C) insurance market in Canada. For more than 50 years, IBC has worked with governments across the country to help make affordable home, auto and business insurance available for all Canadians. IBC supports the vision of consumers and governments trusting, valuing and supporting the private P&C insurance industry. It champions key issues and helps educate consumers on how best to protect their homes, cars, businesses and properties.

For more information, visit www.ibc.ca. If you have a question about home, auto or business insurance, contact IBC’s Consumer Information Centre at 1-844-2ask-IBC.

About CatIQ

Toronto-based Catastrophe Indices and Quantification Inc. (CatIQ) is a subsidiary of Zurich- based PERILS A.G. and delivers detailed analytical and meteorological information on Canadian natural and man-made catastrophes. Through its online subscription-based platform, CatIQ combines comprehensive insured loss and exposure indices and other related information to better serve the needs of the insurance / reinsurance / ILS industries, public sector and other stakeholders. www.catiq.com. CatIQ was established in 2014 with the support of the overwhelming majority of the Canadian insurance and reinsurance industry and is widely recognized as the most reliable source of catastrophe loss information in Canada. CatIQ also partners with MSA Research to host the Canadian catastrophe conference, CatIQ Connect.

Source: Insurance Bureau of Canada (IBC)

Tags: CatIQ, Insurance Bureau of Canada (IBC), Natural Catastrophes, severe weather