SEC Chief Takes Aim at Payment for Order Flow in Sweeping Plans for Stock Markets

What You Need to Know

Gensler said he’d asked staff to weigh changes with the aim of making the equities market more transparent.

If enacted, the plans could mark the biggest overhaul for the U.S. stock market in more than 15 years.

Gensler asked SEC staff to consider creating an order-by-order auction mechanism.

Wall Street’s top regulator previewed a set of sweeping overhauls to the rules underpinning the U,S. stock market, setting up a major clash with some of the biggest names in equity trading.

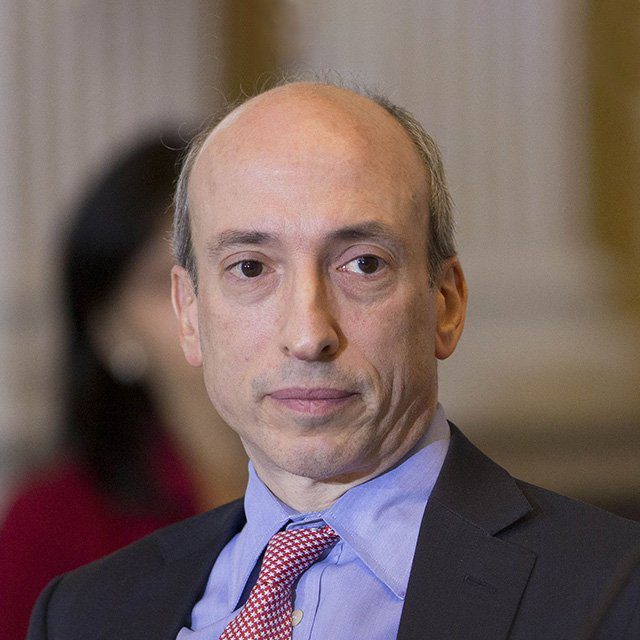

Securities and Exchange Commission Chair Gary Gensler said he’d asked the agency’s staff to weigh changes with the aim of making the equities market more transparent and fair for retail investors. His plans could directly impact how brokerages including Citadel Securities, Virtu Financial Inc. and Robinhood Markets Inc. process many retail trade orders.

The possible changes outlined by Gensler would require two votes by the agency’s commissioners to take effect. If enacted, the plans could mark the biggest overhaul for the U.S. stock market in more than 15 years, and the agency’s most direct response yet to last year’s wild trading in GameStop Corp. and other meme stocks.

“Right now, there isn’t a level playing field among different parts of the market: wholesalers, dark pools, and lit exchanges,” Gensler said in remarks prepared for an event hosted by Piper Sandler. “It’s not clear, given the current market segmentation, concentration, and lack of a level playing field, that our current national market system is as fair and competitive as possible for investors.”

In what would be one of the most significant changes, Gensler asked staff to consider creating an order-by-order auction mechanism intended to help retail traders obtain the best pricing for their orders. The structure would draw on practices now in place in the options market.