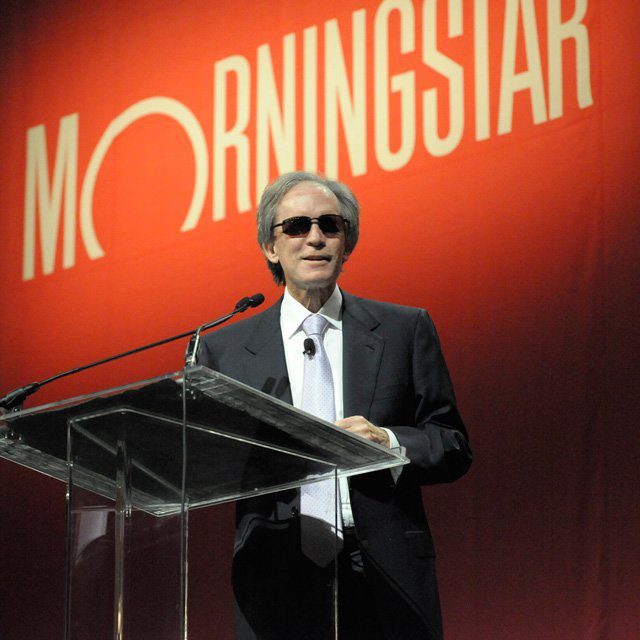

What Happened to Bill Gross? Author Details Bond King's Rise and Fall

Recounted were the developments in the bond market, such as the new Ginnie Mae contract with its “secret lever.” It allowed Pimco to do a “low-key” corner on the market and demand physical delivery, she said. She also mentions “Russian floaters” used to collateralize trades — which wouldn’t necessarily work now, but back then they did.

Gross really made his name during the financial crisis in 2007. He saw the extreme “Big Short” trades as risky and kept the company out of them, even as his fund performance fell below peers for the first time. However, they did bet against mortgages, which, as Trubey said, “went very, very well for them. When things did turn, Pimco was able to buy back securities at a steep discount.”

One reason, Childs said, was that Pimco was far more comfortable in the mortgage market, and “things really did work in their favor; they were smarter, they structured [the trades] very well.”

The End

But “peak Pimco” did not last all that long, Trubey said. When did Gross’ focus shift to internal politics, rather than competition outside the firm, Trubey asked.

When El-Erian left in early 2014, Gross, who according to Childs had largely focused on his trading, now turned to internal company politics, she said. It began with The Financial Times’ article on El-Erian’s resignation, stating it was due to friction within the company. That and the subsequent Wall Street Journal article “planted the seed in Bill Gross’s mind on who is doing this, who is leaking” inside information, she said. “And he was never able to get rid of that [concern].”

Shortly after, Gross left Pimco and went to Janus, and the market had high hopes. Trumbey pointed out that Janus stock was up 40% when Gross joined the company.

What happened? Trumbey asked.

Childs noted that because Gross was gunning so hard, “he lost sight of his own risk management” principles and “all the things that led to his great track record.” She added that “the main thing is his vision was clouded by the emotional stuff” in leaving Pimco.

Since Gross left Pimco, the Total Return fund he once managed has had $150 billion in outflows and is now at $62 billion, Trubey said. And it is in the 39th percentile of its Morningstar category, Trubey said, asking Childs how she thinks it has done.

“They’ve done a remarkable job of holding it together,” she responded. “They have surprised people on how stable it’s been.”

When asked by the audience if she knows how Gross felt about her book, she said there were some facts he didn’t like. Also, he had put out his own book before hers was published, leading her to note, “ever front-running.”