How to sell a house in probate

If you’ve been asked to manage the estate of a deceased loved one, relative or friend – i.e. you’ve been named as an executor of a will – you may well find yourself needing to sell a house in probate.

This will probably happen if the deceased person owned a home in their sole name, and the value of the estate needs to be split between his or her surviving beneficiaries.

What is probate?

Probate is the process of getting legal permission from the court to dispose of an estate, as detailed in the will, of someone who has died.

An executor named in the will is responsible for administering the late person’s affairs. This is usually a friend or family member of the deceased, though some people name their solicitor as executor.

Usually, an executor needs to obtain a grant of probate before they can begin to administer the will and settle any outstanding debts and pass on any inheritances. This involves several steps, including registering the death, getting the estate valued and paying inheritance tax and probate fees.

What does it mean to sell a house in probate?

If you are selling a house in probate, it’s important to be aware that it can be quite a lengthy process. You will need to get a grant of probate in place before completing the sale, which can take several months. You can, however, have the property valued and put on the market before probate has been granted. If someone makes an offer on the property, you can accept it, but you will need to wait for probate before exchanging contracts.

Can you sell a house without probate?

You can advertise the property, conduct viewings and agree a price on the property, but you won’t actually be able to exchange contracts on the sale of the property without a certificate of probate being issued.

Can you sell a house before probate?

Probate can take several months to obtain and although you can put the property on the market for sale before probate, you cannot complete the sale without it. It’s important to tell the estate agents and your solicitor that the property being put on the market is pending probate.

The six steps for selling a house in probate

1. Register the death

You will need to provide a death certificate and a copy of the will naming you as executor.

2. Get the house valued

You need to know the value of the property in order to apply for a grant of probate. Get several valuations and use the average in your probate application.

3. Check the title and deeds of the property so you know about land or property restrictions

You should be able to find information on restrictions through HM Land Registry. If not, you’ll need to find the title deeds, which will probably be in safe keeping with the deceased’s solicitor.

4. Check the home’s insurance status

Getting probate and then selling a house can take many months and if the house is to be left empty during that time it will need to be covered by unoccupied property insurance.

5. Pay inheritance tax

The inheritance tax due on the deceased’s estate must be paid before probate can be granted. As you won’t yet have access to their estate, this isn’t always affordable, but you may be able to use the direct payment scheme to pay tax using money from the estate.

Alternatively, you could apply for an executor’s bridging loan, which provides sufficient funds for the time between applying for probate and gaining access to the deceased’s assets.

6. Apply for a grant of probate

To apply for a grant of probate, you’ll need to complete the form and pay a probate application fee, which costs £273.

Call today for a swift and affordable home insurance quote

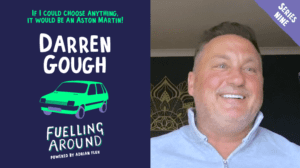

Whether you need unoccupied home insurance for a house in probate, non-standard home insurance for an unusual property or a standard home and household policy, it makes sense to go to a specialist broker such as Adrian Flux.

For a swift hassle-free quote, call 0808 506 6275 today. 79.5% of all customers receiving an online quote in July 2020 could have obtained a cheaper quote over the phone, based on the information they provided.