Zurich renews aggregate catastrophe reinsurance at tighter terms

Global insurance and reinsurance giant Zurich has revealed its new reinsurance program for 2022 and it appears that tighter terms and a tougher market for placing aggregate limit has resulted in a higher attachment point, adjusted deductible and a larger co-participation being taken.

Zurich exhausted its aggregate catastrophe reinsurance protection during the third-quarter of 2021, as significant losses from hurricane Ida and the European floods took their toll on the re/insurer.

The company suffered large losses from both those events, as well as other severe weather and catastrophe outbreaks during the last calendar year, which served to completely erode its aggregate reinsurance protection.

For 2022, Zurich’s reinsurance program has notable changes on the aggregate side of its protection.

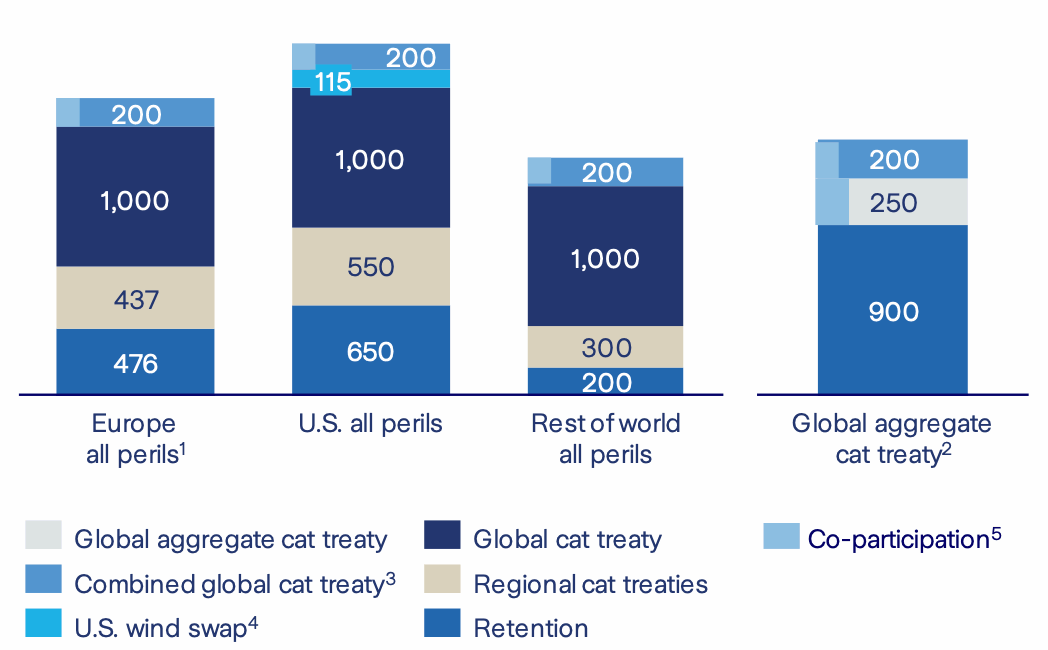

First, the global catastrophe aggregate reinsurance treaty, which for 2022 now attaches for Zurich after a US $900 million retention.

That’s $100 million higher than the 2021 aggregate retention, which analysts this morning have noted suggests that Zurich will be more exposed to catastrophe losses through the coming year.

You can see Zurich’s catastrophe reinsurance program for 2022 below.

As well as raising the retention, Zurich has also changed its co-participation in the aggregate reinsurance protection it has in-force for 2022.

For 2021, Zurich had a 10% co-participation on both a US $250 million global aggregate catastrophe reinsurance treaty and a US $200 million combined global aggregate and occurrence treaty.

For 2022, the co-participation on the $250 million global aggregate cat treaty now stands at a much higher 42.75%, while the co-participation for the $200 million combined agg/occ treaty is at 35.25%.

Again, this implies more chance of Zurich retaining catastrophe and severe weather losses in 2022.

The final change to the aggregate reinsurance side is that Zurich had a franchise deductible in place for 2021, so that losses of US $45 million or greater could count towards the erosion of the aggregate retention during the year.

For 2022, Zurich has purchased its aggregate reinsurance with a fixed occurrence deductible of US $35 million.

Now that is a better arrangement, in terms of more loss events will qualify towards its aggregate towers erosion. But it also means that will erode quicker, raising the chances of it attaching throughout the year.

We don’t know the specific terms of the new fixed occurrence deductible, compared to the franchise deductible. But fixed occurrence deductibles are generally thought better by those offering the aggregate reinsurance coverage. This is a feature we’ve increasingly seen in catastrophe bonds this year.

As a result, it doesn’t necessarily read-across that the fixed deductible will enhance Zurich’s cover, as it may actually mean fewer types of events qualify, although those that do can erode the retention faster.

The aggregate reinsurance changes mean less aggregate coverage though, but with a higher deductible and a greater share being retained through co-participation, this effectively means less aggregate cover for 2022 for Zurich.

It’s no surprise to see these changes, given the way the reinsurance market has hardened and also differentiated on loss experience of cedents.

Aggregate covers have been particularly challenging to place at the January 2022 renewals and even a carrier of the size and stature of Zurich has seemingly been affected, resulting in the reduction in aggregate reinsurance cover.