Nearly a quarter of Americans don't have life insurance, survey claims – Fox Business

About a quarter of U.S. adults don’t have life insurance, and the main reason is that they can’t afford it, according to a recent survey. Here’s how to find cheap life insurance. (iStock)

Life insurance is a way to financially provide for your loved ones and cover final expenses if you die unexpectedly.

But nearly a quarter (23%) of U.S. adults don’t have life insurance coverage, according to a new survey from Consumer Affairs. And, consequentially, 22% of breadwinners are worried their dependents would not be able to meet their financial obligations if they died.

The primary reason why people said they don’t have a life insurance policy was that they don’t believe they can afford it (38%). However, it may be possible to find an affordable life insurance policy that fits into your budget and meets your family’s financial needs.

Keep reading to learn how to find the right life insurance policy for your financial situation. You can get free life insurance quotes on Credible’s online financial marketplace.

5 SURPRISING THINGS THAT CAN PREVENT YOU FROM GETTING LIFE INSURANCE

3 ways to get cheap life insurance in 2022

Life insurance offers financial security for your loved ones, but finding a policy that meets your needs doesn’t have to be expensive. Here are three ways to save money on life insurance:

Take out a life insurance policy while you’re youngChoose a term life insurance policy over whole life insuranceShop around across multiple life insurance companies

Learn more about each strategy in the sections below.

1. Take out a life insurance policy while you’re young

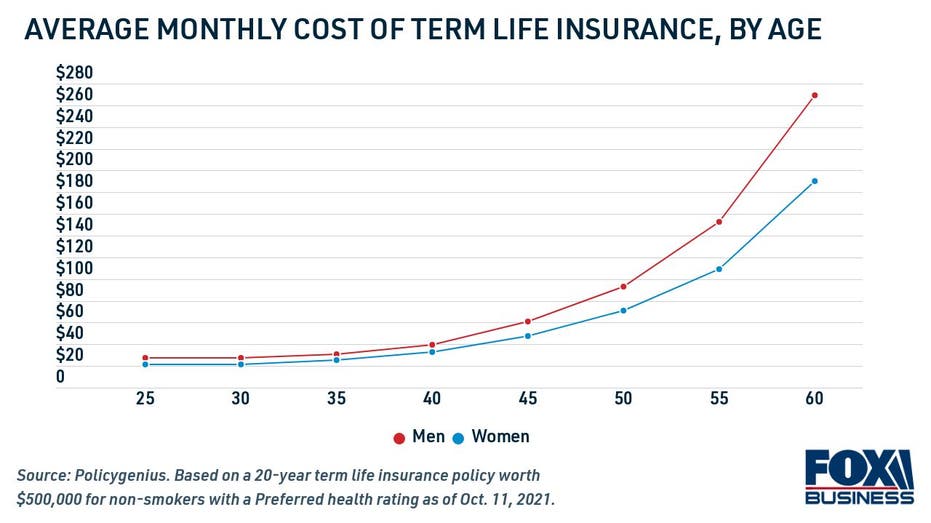

A quarter of Americans without life insurance believe that they’re too young to think about it, according to the survey. But if your goal is to lock in the lowest life insurance rates possible, then it’s better to take out a policy sooner rather than later. That’s because monthly life insurance premiums rise based in part on a person’s age, according to Policygenius.

A healthy female who purchases a $500,000, 20-year term life insurance policy at age 35 will save about $22 on her monthly premiums than if she took out the policy at 45 years old. That may not seem like much, but it adds up to $5,300 over the length of the policy. A male with the same policy would save a little more than $30 per month, translating to nearly $7,300 worth of savings over time.

It’s important to keep in mind that the life insurance coverage you need will vary based on the age of your beneficiaries and your expected retirement age, as well. For example, a 35-year-old parent may consider a 30-year term life insurance policy to carry them into retirement, but they may only need a 20-year policy if their children will reach adulthood by the time they turn 55.

You can visit Credible to determine your life insurance needs and find the policy that’s right for you.

GETTING LIFE INSURANCE WHILE YOU’RE YOUNG AND HEALTHY CAN SAVE YOU THOUSANDS

2. Choose a term life insurance policy over whole life insurance

There are two primary types of life insurance: term and whole, also known as a permanent policy. Term policies typically cover you for a period of 10 years to 30 years, whereas whole life insurance policies are paid for the rest of your life, regardless of how long you’ve made payments.

Because there’s a guaranteed cash value and death benefit payout, a permanent life insurance policy is typically much more expensive than term life insurance. The cost of term life insurance varies depending on the policy length — longer policies will keep you covered for a longer period of time so they have higher monthly premiums.

If you’re searching for affordable life insurance, then a term policy may be a better fit for your needs than a permanent policy. You can compare term and whole life policies for free on Credible.

TERM VS. UNIVERSAL LIFE INSURANCE: HOW TO DECIDE WHAT’S RIGHT FOR YOU

3. Shop around across multiple life insurance products

Life insurance companies set rates based on the policy length and amount of coverage, as well as a policyholder’s age, medical history and lifestyle choices. Most insurers require you to undergo a medical exam to determine any disabilities or underlying health conditions.

However, life insurance premiums may vary from one insurer to another, which is why it’s important to compare rates across multiple companies. Getting quotes from different insurance companies can help you get the most competitive rate possible, and most providers let you see your estimated rate for free.

One way to simplify the process is to visit Credible to compare your life insurance options across multiple insurers at once. That way, you can find the best life insurance company for your situation.

AVERAGE LIFE INSURANCE RATES ARE STEADY ENTERING 2022

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.