Alarming Statistics on Alcohol-Impaired Driving in Texas in 2022: A Growing Concern

According to data from the Texas Department of Transportation (TxDOT), alcohol-impaired driving continues to be a significant problem in the state. In 2022, there were 15,728 crashes in Texas that involved alcohol-impaired drivers, resulting in 1,631 fatalities (10,000 deaths every year in the U.S.).

The statistics show that alcohol-impaired driving crashes accounted for 28% of the total traffic fatalities in Texas, and about one in every three traffic deaths in the state was caused by a driver with a blood alcohol concentration (BAC) of 0.08 or higher.

In addition, the data shows that males accounted for a higher percentage of alcohol-impaired driving fatalities (72%) than females (2%). And also a high percentage of the alcohol-impaired driving fatalities occurred during the night-time, specifically between 6 p.m. and 5:59 a.m. (64%).

It’s worth noting that these numbers are just the reported cases, and the actual number of accidents caused by drunk driving in Texas may be higher due to underreporting. These statistics highlight the importance of continuing efforts to reduce the number of alcohol-impaired driving crashes and fatalities in Texas.

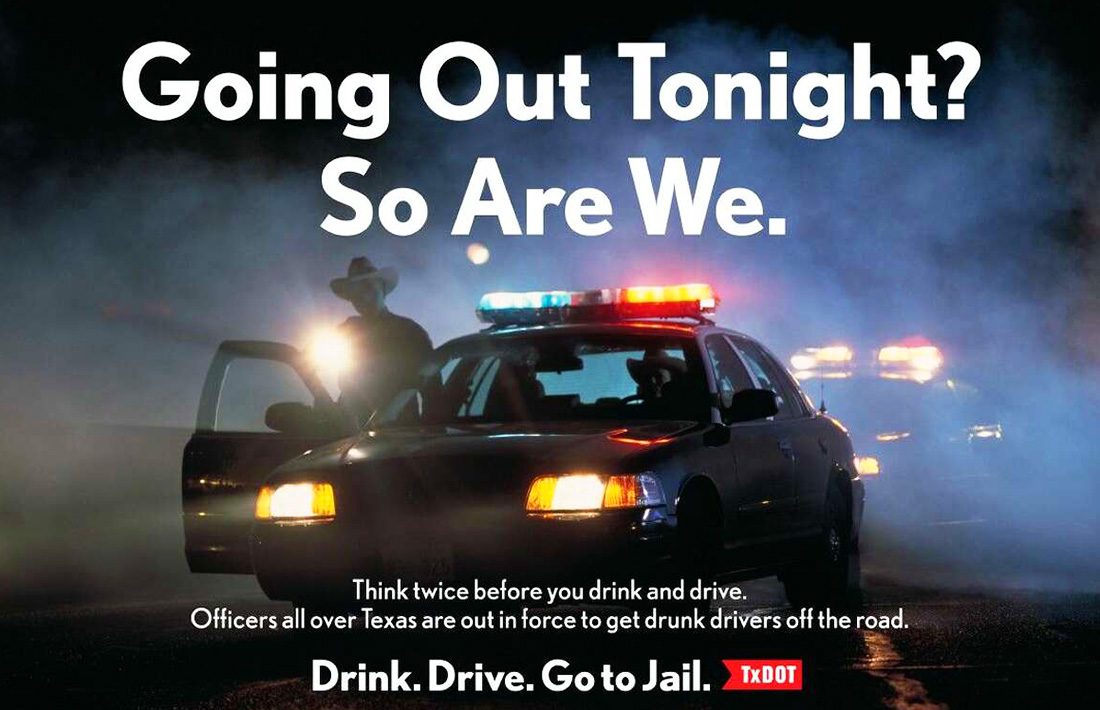

Drivers should also be aware that it is illegal to operate a motor vehicle in Texas with a BAC of 0.08 or higher and that if they’re caught driving under the influence, they can face severe penalties, including fines, jail time, and license suspension. The best way to avoid these risks is to never drink and drive.

SR-22 Insurance in Texas

Another consequence of “driving and drive” is that, after a DUI, you are required to have SR22 insurance

SR-22 insurance, also known as financial responsibility insurance, is a type of auto insurance required by certain states for drivers who have been deemed high-risk. Recently, the state of Texas has seen an increase in the number of drivers who are required to carry SR-22 insurance.

In Texas, drivers may be required to carry SR-22 insurance if they have been convicted of certain serious traffic violations, such as DUI or reckless driving. Additionally, drivers who have been involved in multiple accidents or have a history of uninsured driving may also be required to carry SR-22 insurance.

When a driver is required to carry SR-22 insurance in Texas, they must file an SR-22 form with the Texas Department of Public Safety. The form must be filed by the driver’s insurance company, and it certifies that the driver has the required liability insurance coverage. The form must be kept on file with the DPS for a period of two years from the date of the conviction or other event that triggered the requirement.

It’s important to note that SR-22 insurance is not a type of coverage, it is a certification that a driver has met their state’s minimum liability coverage requirement. This means that drivers will still need to purchase standard auto insurance policies, in addition to the SR-22 filing.

Drivers who are required to carry SR-22 insurance in Texas may find that their insurance rates increase as a result. Because they are considered high-risk, they may be charged higher premiums than other drivers. However, it is still possible to find affordable SR-22 insurance in Texas by shopping around and comparing quotes from different insurance companies.

Overall, SR-22 insurance is a requirement for high-risk drivers in Texas, which is becoming increasingly common these days. It is important for drivers to understand the requirements and to be aware of the potential impact on their insurance rates. It’s also important to note that failure to maintain SR-22 insurance can result in a license suspension, so it’s crucial to stay compliant with state laws.

Insurer Who Sues Insured for Fraud Without Evidence Should be Punished

Insurer Who Sues Insured for Fraud Without Evidence Should be Punished  A Guide to Health Insurance for Expats

A Guide to Health Insurance for Expats  Life Insurance Agents: Everything You Need to Know

Life Insurance Agents: Everything You Need to Know  SCOR secures 20% upsized $240m of retrocession from Atlas Capital 2025-1 cat bond

SCOR secures 20% upsized $240m of retrocession from Atlas Capital 2025-1 cat bond